How to Measure Operational Efficiency: Boost Your Business

Discover how to measure operational efficiency with key metrics. Learn practical strategies to improve productivity and drive growth today.

To get a real handle on your operational efficiency, you need a simple way to see what you’re getting out for what you’re putting in. The classic formula is Efficiency = Total Output / Total Input. By working out this ratio, you’re not just getting a number; you’re setting a benchmark. It’s this baseline that lets you track real progress and make much sharper, data-informed decisions down the track.

What Is Operational Efficiency and How Do You Measure It?

Before you can start improving things, you need to be clear on what you’re actually measuring. At its heart, operational efficiency is all about generating the most value while minimising waste. It’s a common misconception that this just means slashing costs. It’s much bigger than that. It’s about fine-tuning the entire process of how your business delivers its products or services to squeeze maximum value from every dollar, hour, and resource you invest.

I like to think of it as the performance rating of your business’s engine. A finely tuned, efficient engine will take you further on less fuel. An inefficient one just chews through resources without giving you the results to show for it. This idea holds true for any business, whether you’re running a manufacturing plant in Perth, a digital agency in Sydney, or a retail chain with stores across the country.

The Core Efficiency Formula

The most direct way to get started is by using that fundamental efficiency formula we just mentioned. To make it work for you, the first step is to clearly define what ‘output’ and ‘input’ actually look like in your business.

Operational efficiency is a direct measure of profitability and sustainability. It reveals how effectively an organisation converts its inputs like capital, labour, and materials into valuable outputs like revenue and finished goods.

To help you figure out which variables make sense for your own calculations, I’ve broken down the common components below with some practical examples for Australian businesses.

Core Components for Measuring Your Efficiency Ratio

This table gives a breakdown of common business outputs and inputs to help you calculate your baseline operational efficiency.

| Component Type | Definition | Examples for Australian Businesses |

|---|---|---|

| Output (What you produce) | The quantifiable results, products, or services your business generates. | Revenue, units manufactured, projects completed, new customers acquired, services delivered. |

| Input (What you use) | The resources consumed to generate the output, including time, money, and materials. | Labour hours, operational costs, raw material costs, marketing spend, software subscriptions. |

Choosing the right metrics from this table is what brings the formula to life.

For example, a construction company in Melbourne might measure its efficiency by dividing the total square metres built (output) by its total labour hours and material costs (input). On the other hand, a software-as-a-service (SaaS) company could calculate its efficiency by dividing its monthly recurring revenue (output) by its total operational expenses, including salaries and server costs (input). The key is choosing metrics that genuinely reflect your business model.

Understanding Efficiency on a National Scale

This input-versus-output thinking isn’t just for individual businesses; it’s a vital sign of economic health on a national level.

Here in Australia, a key measure is Gross Domestic Product (GDP) per hour worked, which is essentially a national labour productivity score. This metric compares our country’s total economic output (GDP) against the total hours worked by the labour force. It tells us how effectively we’re using our human capital. You can actually dig into this yourself by exploring how the Australian Bureau of Statistics tracks national accounts data. Looking at this broader context is a great way to benchmark your own performance against what’s happening in your industry and the economy as a whole.

Selecting the Right Efficiency Metrics for Your Business

Choosing the wrong metrics is a classic mistake. It can send you down a rabbit hole of measuring sheer activity instead of genuine business impact. To truly get a handle on operational efficiency, you need to pick Key Performance Indicators (KPIs) that reflect the health of your specific business. What works for a bustling retail store is completely different to what a professional services firm needs to track.

This isn’t about collecting data for the sake of it. The goal is to align what you measure with your core business objectives, ensuring every metric directly contributes to tangible outcomes, like better profitability or happier customers.

Tailoring Metrics to Your Industry

One of the biggest blunders I see is businesses adopting generic metrics that simply don’t fit their model. To get this right, you have to match your KPIs to your primary business function. Let’s look at a few real-world examples.

An Adelaide-based manufacturing firm, for instance, would get immense value from tracking Overall Equipment Effectiveness (OEE). This single metric cleverly combines machine availability, performance, and quality into one score, giving a powerful snapshot of production efficiency. A high OEE score tells you your machinery is running near its peak with minimal downtime or defects.

But for a service-based business, like a digital marketing agency in Melbourne, OEE is useless. They need to focus on metrics that measure the efficiency of their people and processes.

- Client Project Completion Rate: This shows how effectively the team delivers on its promises within agreed-upon timelines.

- Billable Hours Ratio: By comparing hours billed to clients against total staff hours worked, you can see how much time is actually spent on revenue-generating activities.

- Customer Lifetime Value (LTV): This helps the agency understand the long-term profitability of its client relationships, guiding account management and retention strategies.

For a retail operation, the focus shifts again. A fashion boutique in Brisbane would need to keep a close eye on:

- Inventory Turnover: This shows how quickly stock is sold and replaced. A high turnover is a great sign of strong sales, while a low rate means precious capital is tied up in slow-moving products.

- Sales Per Square Metre: This KPI is crucial for measuring how effectively the physical retail space is being used to generate revenue, helping to optimise store layouts and product placement.

By selecting industry-specific metrics, you move from simply tracking numbers to gaining actionable insights. You start to see not just what is happening, but why it’s happening, which is the first step toward meaningful improvement.

Aligning Metrics with Strategic Goals

Once you’ve zeroed in on relevant industry metrics, the next step is ensuring they actually line up with your overarching business goals. Efficiency for its own sake is pointless; you want efficiency that drives strategic success.

Let’s take a Sydney-based plumbing company. Their primary goal might be to boost profitability by completing more jobs per day without letting quality slip.

Strategic Goal: Increase daily job completion and profitability.

Corresponding Efficiency Metrics:

- Average Job Completion Time: Tracking this helps pinpoint where technicians are losing time. Is it travel, sourcing parts, or on-site diagnosis?

- First-Time Fix Rate: A high rate here means fewer costly return visits, which directly boosts profitability and keeps customers happy.

- Revenue Per Technician: This ties individual performance directly to the company’s financial health.

By monitoring these specific KPIs, the plumbing company can quickly identify the bottlenecks in its operations. Perhaps technicians need better-stocked vans to cut down on trips to suppliers, or maybe the daily schedule can be optimised to minimise travel time between jobs. The data gives them a clear path to action.

To get a complete picture of these operational pathways, many businesses find it invaluable to visually map out their processes. Exploring different business process mapping techniques can help clarify every step, making it far easier to spot inefficiencies and select the most impactful metrics to track.

Getting your metrics right is a foundational piece of the puzzle. It takes some thoughtful analysis of your industry, business model, and strategic goals, but it ensures your efforts are focused where they’ll deliver the greatest return.

A Practical Guide to Capturing and Analysing Data

Knowing which metrics to track is the first hurdle. The next, and arguably more complex, challenge is figuring out how to consistently capture and analyse the data you need. This is where you turn abstract goals into tangible insights, moving from simply knowing what to measure to understanding what the numbers truly mean for your business. The key lies in building a systematic approach.

Believe it or not, you’re probably already sitting on a goldmine of operational data. Many Australian businesses have valuable information tucked away in their existing software. Your Xero or MYOB account holds a wealth of financial inputs, while your CRM tracks sales outputs and client interactions. Even if your operation isn’t fully digitised, those handwritten timesheets or job logs can provide a solid baseline to start from.

Establishing a Data Collection Rhythm

Once you’ve identified your data sources, you need to get into a consistent collection rhythm. Whether you do this daily, weekly, or monthly really depends on the metric itself. Some data, like website conversions or daily production counts, changes quickly and needs frequent tracking. Broader financial ratios, on the other hand, are often best reviewed on a monthly basis.

Here’s the thing: consistency is far more important than frequency. Sporadic data collection makes it impossible to spot meaningful trends. You end up with a series of disconnected snapshots instead of a continuous story of your operational performance.

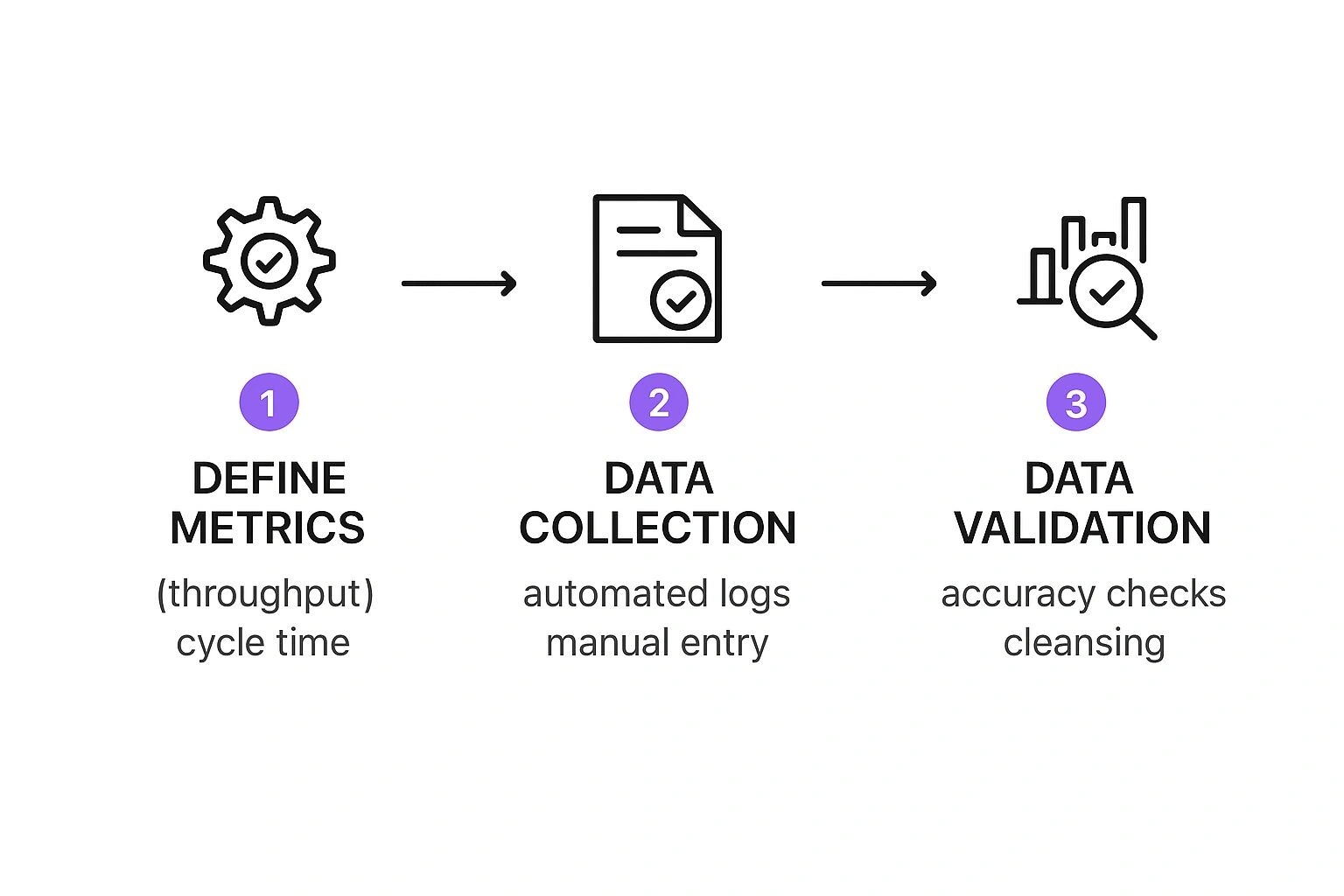

The process of turning raw information into reliable business intelligence follows a clear path.

This visual shows that simply capturing data isn’t enough. You have to validate it to ensure its accuracy before you can confidently make decisions based on it.

From Raw Data to Actionable Insights

With clean, consistent data in hand, the real work begins. This is where you connect the dots between your operational activities and your business outcomes. Start by calculating your chosen efficiency ratios over time. Plotting these on a simple chart will quickly reveal patterns, helping you spot performance peaks, troughs, and anomalies that need a closer look.

For service-based businesses, exploring efficient job and cost tracking methods can seriously simplify this process.

For many businesses just starting out, a well-organised spreadsheet is a perfectly good tool for initial analysis. You can use it to:

- Track KPIs Over Time: Create simple line or bar charts to visualise performance trends.

- Identify Bottlenecks: Look for metrics that are consistently underperforming. For example, a steady increase in ‘average task completion time’ clearly points to a growing bottleneck.

- Calculate Key Ratios: Use formulas to automatically calculate your efficiency ratios, which saves time and ensures accuracy.

The goal of analysis isn’t just to report numbers; it’s to ask better questions. Why did our output per employee dip last Tuesday? What caused that spike in material waste during the first week of the month? These questions turn passive data review into an active hunt for improvement opportunities.

A key benchmark used in Australia is multifactor productivity (MFP), which measures outputs relative to combined inputs like labour and capital. According to the Australian Productivity Commission, the market sector’s MFP recently grew by only 0.1%, falling short of the 0.3% 20-year average. This points to a nationwide slowdown in efficiency gains. If you want to see how you stack up, you can explore the Productivity Commission’s latest bulletin to compare your performance against industry benchmarks.

Knowing When to Upgrade Your Toolkit

While spreadsheets are a fantastic starting point, they have their limits. As your business grows and your data becomes more complex, manual analysis can become a bottleneck in itself. This is often the signal that it’s time to invest in a dedicated Business Intelligence (BI) platform.

Tools like Microsoft Power BI or Tableau can automate the entire workflow, from data collection to visualisation. They connect directly to your various data sources, giving you a real-time, interactive dashboard of your operational health. This frees up your team from tedious data entry, allowing them to focus on the strategic analysis that truly drives your business forward.

Benchmarking Your Performance Against Industry Standards

Knowing your own numbers is one thing, but that data exists in a vacuum. The real strategic edge comes when you know how you stack up against everyone else. Without that external context, you’re essentially flying blind. Benchmarking against industry standards pulls back the curtain, showing you what’s truly possible and where your most significant gaps are.

This isn’t just a casual glance at a competitor’s website. It’s a methodical process of measuring your performance against the best in your field. It allows you to pinpoint, understand, and then adapt the successful strategies of top performers for your own business. It’s the difference between guessing where you can improve and knowing exactly which target to aim for.

Finding Reliable Benchmarking Data

For any Australian business, the first hurdle is finding relevant, local data. Global averages are interesting, but they won’t give you the sharp insights needed to compete effectively here at home. You need reliable sources that reflect our market conditions and competitive pressures.

So, where do you look? Some of the best sources for high-quality data include:

- Industry Association Reports: Groups like the Australian Industry Group (Ai Group) or sector-specific bodies for manufacturing, retail, or tech often publish incredibly detailed performance reports for their members.

- Government Publications: Don’t overlook agencies like the Australian Productivity Commission. They provide deep-dive analyses of productivity trends across various sectors that are invaluable.

- Financial Benchmarking Services: Specialised firms can offer anonymised, aggregated data from companies in your sector, allowing for direct comparisons on crucial financial ratios.

- Market Research Firms: Companies like IBISWorld produce detailed industry reports that are packed with key performance benchmarks and operational statistics.

Tapping into these resources helps you move beyond basic revenue comparisons. You can start analysing the specific metrics that truly drive operational excellence in your sector. Of course, gathering this data efficiently is often a challenge in itself, which is where system integration enhances operational efficiency.

Understanding the Productivity Frontier

A powerful concept I always come back to in benchmarking is the ‘productivity frontier’. Think of it as the gold standard, the maximum performance level achieved by the best-in-class companies in your industry, given the available technology and resources. Your position relative to this frontier reveals your ‘efficiency gap’, which is your real potential for improvement.

The real value of benchmarking isn’t just seeing who is best; it’s about quantifying the gap between your current state and the best possible state. This gap represents your opportunity.

This is a critical concept for Australian firms. For instance, data on multifactor productivity (MFP) from the Productivity Commission consistently shows a gap between the average firm’s performance and the MFP frontier. In key sectors like agriculture and manufacturing, these inefficiency gaps suggest businesses could boost their output by 20% to 40% simply by adopting best practices. You can read the full analysis on this productivity gap for a much deeper look.

A Practical Benchmarking Example

Let’s bring this to life. Imagine a mid-sized manufacturing firm based in western Sydney. They’ve been diligently tracking their own multifactor productivity and have seen some modest, single-digit growth over the past three years. On the surface, they feel like they’re doing pretty well.

But then they get their hands on an industry association report. They discover that the average MFP for firms of their size is actually 15% higher than their own. Even more sobering, the top quartile of performers, those operating at the productivity frontier, are running at an MFP level 35% higher.

Suddenly, their perspective is completely transformed. Their internal gains, while positive, were merely keeping them in the race, not helping them close the gap with the leaders. This benchmark reveals a significant efficiency gap and gives them a clear, quantified target. They now know that a 35% improvement isn’t a pipe dream; it’s actively being achieved by their peers. This knowledge empowers them to launch targeted projects in supply chain logistics and production line automation, confident that their goals are grounded firmly in market reality.

Turning Efficiency Data Into Actionable Improvements

Gathering data on your operational performance is a great start, but its real value only shines through when you use it to drive meaningful change. Data sitting in a spreadsheet or a dashboard is just noise until you act on it. The most critical part of this whole process is translating those numbers and trends into a targeted plan for real-world improvement.

This is where we move from theory to practice. It’s all about taking what you’ve learned and using it to refine your processes, cut out the waste, and ultimately boost your bottom line.

Digging Deeper with Root Cause Analysis

When a metric like machine downtime or project delays suddenly spikes, the gut reaction is often to treat the most obvious symptom. I’ve seen it time and again. It’s a common mistake that leads to temporary fixes, not lasting solutions. To make a genuine difference, you have to uncover the root cause of the problem.

A brilliantly simple yet powerful technique for this is the 5 Whys. Developed by Sakichi Toyoda for the Toyota Production System, this method involves repeatedly asking “Why?” to peel back the layers of an issue until you get to its core.

Let’s walk through a scenario. Imagine a manufacturing business identifies high machine downtime as a major inefficiency.

- Problem: Machine #3 had excessive downtime last week.

- Why? A critical component failed unexpectedly.

- Why? It wasn’t replaced during its scheduled service window.

- Why? The preventative maintenance schedule wasn’t followed correctly.

- Why? The maintenance technician was pulled away for an urgent, unplanned repair on another line.

- Why? We don’t have enough staff coverage for both planned maintenance and emergency repairs.

All of a sudden, the problem isn’t a faulty machine part; it’s a resource allocation and staffing issue. Sure, fixing the part is a necessary patch, but addressing the staffing problem prevents this entire chain of events from reoccurring.

By pushing past surface-level issues, Root Cause Analysis ensures you’re investing your time and money into solutions that fix the actual problem, delivering a much higher return on your improvement efforts.

From Analysis to Actionable Strategies

Once you truly understand the root causes of your inefficiencies, you can start developing targeted strategies to tackle them. These actions need to be specific, measurable, and tied directly to the data you’ve collected. This isn’t about overhauling your entire operation overnight. It’s about making focused, intelligent changes that will have the biggest impact.

For a more structured approach to making these changes stick, you might want to explore guides on business process improvement, which detail how to methodically refine your workflows.

Let’s look at a few common inefficiencies and the practical actions you can take.

- Process Mapping to Cut Redundant Steps: Visually mapping a workflow from start to finish is one of the fastest ways I’ve found to spot unnecessary tasks, approval bottlenecks, or duplicated effort. It puts it all out in the open.

- Implementing Lean Principles: The core idea of ‘lean’ is to maximise value for the customer while minimising waste. This isn’t just for manufacturing. Any business can apply it by identifying and eliminating activities that don’t add value, such as excess inventory, unnecessary movement of people or materials, and waiting times.

- Using Automation for Repetitive Tasks: If tasks like data entry, report generation, or client follow-ups are eating up significant staff hours, automation can be a game-changer. It frees up your team to focus on higher-value work that demands human creativity and critical thinking.

To get your data working for you, it helps to review practical strategies to improve workflow efficiency. This can provide a solid framework for turning your insights into a concrete plan.

A Real-World Improvement Example

Consider a small Australian e-commerce business that was struggling with slow order fulfilment times, a metric that was directly hurting customer satisfaction. Their initial data showed the average time from order placement to dispatch was a painful 48 hours, well above the industry standard.

Instead of just telling staff to “work faster,” the owner dug into the data. By analysing sales records, they uncovered a classic Pareto principle situation: 80% of their orders came from just 20% of their product catalogue.

The problem? Their physical warehouse layout was organised by supplier, not by sales velocity. This meant staff were wasting huge amounts of time walking across the entire warehouse to pick items for a single order.

The solution was simple but incredibly effective. They reorganised the warehouse, placing the top-selling items closest to the packing station. This small change, driven entirely by data analysis, cut the average picking time per order by more than half. Within a month, their average fulfilment time dropped from 48 hours to just 18 hours. The result was a noticeable increase in positive customer reviews and repeat business. It’s a perfect example of how a simple, data-informed change can have a massive impact.

Frequently Asked Questions About Operational Efficiency

As you start digging into how to measure and improve your operations, it’s natural for practical questions to pop up. Getting clear, straightforward answers is crucial for moving past roadblocks and building momentum. Here are some of the most common queries we hear from Australian businesses tackling this for the first time.

How Often Should I Measure Operational Efficiency?

The honest answer? It really depends on the metric and the rhythm of your business. Some things need a close eye, while others can be checked less frequently.

For instance, critical operational metrics, like a factory’s daily production output or a retailer’s sales per employee, benefit from daily or at least weekly tracking. This lets you spot and fix problems almost as they happen.

On the other hand, broader financial ratios, such as your operating margin, are usually reviewed monthly or quarterly to align with your financial reporting cycles. The key isn’t a one-size-fits-all schedule, but establishing a consistent rhythm. This allows you to spot trends and act on insights in a timely manner, without getting completely swamped by data.

A good tip: if you’re launching a new initiative, you might measure its key metrics more often at the start, then ease off once the process has stabilised.

What Is The Difference Between Productivity And Efficiency?

People often use these terms interchangeably, but in a business context, they mean two very different things. Nailing this distinction is vital for figuring out what you should actually be measuring.

- Productivity is all about volume. It’s a simple measure of the quantity of output produced from a given input. Think: number of units manufactured per hour.

- Efficiency, however, measures your performance against a standard or an optimal benchmark. It’s about quality and effectiveness.

Here’s a practical example. Your team could be highly productive, assembling 100 widgets an hour. But if the industry standard, or the machine’s optimal rate, is 120 widgets an hour, your efficiency is only running at about 83%. In short, productivity is about how much you do, while efficiency is about how well you do it.

My Business Is Service-Based. How Can I Measure Efficiency?

This is a great question. When you’re not making physical products, measuring efficiency means shifting your focus from widgets to inputs and outputs related to time, cost, and quality. You can’t count units, but you can absolutely measure value.

For service businesses, efficiency isn’t about widgets per hour; it’s about maximising client value and project success while minimising the cost of delivery. Time is your primary inventory.

Some of the most powerful metrics for a service-based business include:

- Billable Hours Ratio: The total number of billable hours divided by the total hours worked by your staff. It’s a direct measure of how much revenue-generating time you have.

- Average Task Completion Time: How long does it take your team to complete common project deliverables? Tracking this helps you scope future work more accurately.

- Client Retention Rate: A fantastic indicator of service quality and overall client satisfaction. Happy clients stick around.

- Cost Per Service Delivery: This involves calculating all costs, including overheads, associated with a particular client project or service.

You can also get creative and measure the efficiency of internal processes, like your sales conversion rate from proposal to signed client. The principle is exactly the same: maximise valuable output (happy clients, completed projects, revenue) while minimising your input of resources (staff time, overheads).

What Are Some Common Mistakes To Avoid?

Knowing what to measure is only half the battle; knowing the common traps to avoid can save you a world of time and frustration.

A frequent mistake we see is tracking ‘vanity metrics’. These are numbers that might look impressive on a dashboard, like website traffic, but don’t actually correlate to business success or profitability. Always ask if a metric links directly to a business outcome.

Another classic error is trying to measure too many things at once. This almost always leads to data overload and inaction because the team simply doesn’t know where to focus their efforts. Start small with a few key metrics.

Inconsistent data collection is a big one, too. If your methods change, your data becomes unreliable and you can’t analyse trends over time. And finally, a huge mistake is failing to explain the ‘why’ to your team. If employees see these metrics as a stick to be beaten with rather than a tool for collaborative improvement, they’ll either resist the initiative or, even worse, find ways to game the system.

At Osher Digital, we help businesses move beyond manual tracking by implementing custom automation and AI agent development that provide real-time, accurate efficiency improvements. If you are ready to unlock a new level of performance in your operations, explore our solutions at osher.com.au.

Jump to a section

Ready to streamline your operations?

Get in touch for a free consultation to see how we can streamline your operations and increase your productivity.