AI in Banking and Finance: A Guide for Australian Businesses

Talking about artificial intelligence in banking and finance might bring to mind images of robot tellers or something from a sci-fi film. The reality is much more practical. Think of it less as a robot replacement and more as giving your team a super-smart assistant that never sleeps. It’s about using clever technology to look […]

Talking about artificial intelligence in banking and finance might bring to mind images of robot tellers or something from a sci-fi film. The reality is much more practical. Think of it less as a robot replacement and more as giving your team a super-smart assistant that never sleeps.

It’s about using clever technology to look at huge amounts of data, spot the subtle patterns humans might miss, and automate the repetitive, boring tasks that slow everyone down. Done right, this technology makes your operations faster, smarter, and much more secure.

Demystifying AI in Banking and Finance

When people hear “AI in banking”, their minds often jump to complex, futuristic systems that feel out of reach. But the main idea is surprisingly simple.

Let’s use an analogy. Imagine you’re training a new junior analyst. You give them a mountain of old loan applications to review, every single one your bank has processed for years. They study the details, learning which were approved, which were rejected, and most importantly, why. After a while, they get really good at spotting the signs of a trustworthy borrower, predicting the outcome of new applications with incredible speed and accuracy.

This is exactly how AI works, just on a scale that’s impossible for humans. It processes millions of data points, learning and making predictions with a level of precision that a human team just can’t match. It’s not about replacing experienced experts; it’s about giving them powerful, data-driven tools.

What AI Really Does

Instead of getting bogged down in technical terms, let’s focus on what this technology actually does. Cutting through the hype, AI in the financial sector essentially helps with three key things:

- Automating Repetitive Work: It takes over tasks like manual data entry, sending customer enquiries to the right person, or running standard compliance checks. This frees up your skilled people to focus on important, strategic work.

- Sharpening Decision-Making: By looking at huge datasets, it provides deep insights for credit scoring, fraud detection, and investment strategies. It acts like a powerful analytical partner.

- Improving Customer Interactions: It powers the chatbots that provide instant, 24/7 support and helps personalise product offers based on a customer’s unique financial behaviour.

AI isn’t here to replace financial professionals. Instead, it acts as a powerful helper, handling the number-crunching and pattern-spotting so humans can focus on strategy, client relationships, and complex problem-solving.

Ultimately, the conversation around AI in banking and finance is about making financial services more efficient, secure, and responsive to what customers actually need. It’s a tool that gives you a big competitive advantage when used correctly. For a comprehensive look at the scope of AI in financial services, many great resources explore its growing impact.

The systems that power this change, often called AI agents, are now more accessible than ever. Understanding AI agent development is the first step towards building these capabilities into your own operations. In the sections that follow, we’ll dive into the specific ways this technology is already reshaping the Australian financial landscape.

How AI Is Reshaping Australian Finance

The real impact of AI in banking and finance is already happening across Australia. It’s moved well beyond theory and into everyday operations. This isn’t about some distant future; it’s about practical tools making finance safer, faster, and more customer-focused right now. And confidence in this technology is growing fast.

A recent PwC Australia CEO Survey found that 37% of Australian CEOs now have high confidence in AI, a noticeable jump from 31% just the year before. This feeling is particularly strong in financial services, where leaders are actively using AI to find an edge in a fiercely competitive market.

So, where is this technology already at work? Let’s look at some of the most powerful uses.

Your Most Vigilant Fraud Detective

Think of an AI fraud detection system as the most dedicated detective you could ever hire. It works around the clock, never gets tired, and can sift through millions of transactions in the blink of an eye. While a human team might spot suspicious activity by looking at a handful of flagged accounts, an AI sees everything at once.

It quickly learns the normal spending habits of every single customer. For example, it knows you usually buy coffee in Melbourne on weekday mornings and do your grocery shopping on a Saturday. If a transaction suddenly appears from an overseas website at 3 AM for a large amount, the AI instantly flags it as out of character, often before the fraudulent payment even processes.

This constant, real-time monitoring means financial institutions can stop fraud before it causes major headaches, protecting both the business and its customers. It’s a level of security that’s simply impossible to achieve at a human scale.

A Fairer and Faster Loan Officer

The traditional process of applying for a loan can be painfully slow and, at times, feel quite subjective. AI is changing this by acting as a remarkably consistent and data-driven loan officer. It assesses credit risk by looking at thousands of data points, far more than what’s in a standard credit file.

Instead of just looking at past payment history, it can consider factors like income stability and detailed spending patterns to build a much richer picture of an applicant’s financial health. This purely data-driven approach helps remove unintentional human bias from the decision-making process, leading to fairer outcomes for everyone.

By focusing strictly on the financial data, AI models ensure that every applicant is assessed against the same objective criteria. This makes the entire credit scoring process more equitable and transparent.

For the customer, this means faster decisions, often within minutes instead of days. For the lender, it means more accurate risk assessments, which reduces the chance of defaults and helps build a healthier loan portfolio.

Automating the Compliance Burden

Financial institutions in Australia face a huge compliance burden, especially around Know Your Customer (KYC) and Anti-Money Laundering (AML) rules. These checks are vital for preventing financial crime, but they have traditionally been manual, repetitive, and incredibly time-consuming.

AI is now automating a massive chunk of this painstaking work. Instead of a compliance officer manually checking identity documents and comparing names against global watchlists, an AI system can do it in seconds. It can scan and validate a passport, cross-reference data across multiple databases, and flag any potential risks for a human expert to look at.

This automation achieves two crucial goals:

- It massively speeds up customer onboarding, creating a much better first impression.

- It reduces human error, ensuring compliance checks are done consistently and accurately every single time.

This frees up compliance teams to move away from routine box-ticking and focus their expertise on investigating genuinely high-risk cases. It’s a perfect example of AI handling the grunt work so humans can focus on critical thinking. For businesses struggling to modernise these processes, working with expert AI consultants can provide a clear path forward.

To put it all together, here’s a quick summary of how these AI applications are solving real-world business challenges in finance today.

Key AI Applications in Banking and Finance

| AI Application | What It Does in Simple Terms | Key Business Problem Solved |

|---|---|---|

| Fraud Detection | Watches transactions in real-time to spot unusual activity that looks like theft. | Reducing financial losses from fraudulent activity and protecting customer accounts. |

| Credit Scoring | Analyses vast amounts of financial data to predict how likely someone is to repay a loan. | Making lending decisions faster, more accurate, and less prone to human bias. |

| KYC/AML Automation | Automatically verifies customer identities and checks them against risk databases. | Cutting down the time and cost of compliance while improving accuracy and customer experience. |

| Algorithmic Trading | Uses complex models to make trades at high speed based on market data. | Increasing trading speed and efficiency, and finding market opportunities humans might miss. |

| Customer Service | Powers chatbots and virtual assistants to answer common questions and guide users. | Providing 24/7 customer support, reducing call centre workloads, and improving response times. |

| Risk Modelling | Simulates market scenarios to predict potential financial risks and their impact. | Improving the accuracy of risk management and helping the business prepare for market volatility. |

Each of these applications shows a shift from manual, reactive processes to automated, predictive operations that are fundamentally changing the industry.

The Tangible Business Benefits of Using AI

Beyond the impressive technology, the real question is what adopting AI in banking and finance actually means for your bottom line. These aren’t just theoretical perks; they are real advantages that Australian finance companies are already seeing today.

Think of it as swapping out manual spreadsheets for a smart, automated system. It isn’t just about working faster. It’s about building a system that works around the clock, catching tiny errors a human might miss, and freeing up your best people to focus on what actually grows the business.

This shift delivers powerful, measurable improvements right across the organisation, from the back office to the front line.

Driving Major Cost Savings

One of the most immediate impacts of AI is its ability to slash operational costs. It does this by taking over the high-volume, repetitive tasks that eat up so much of your team’s time and budget.

Imagine all the hours spent on manual data entry, processing invoices, or handling routine account queries. AI can do these jobs instantly and without error, allowing you to move staff onto more strategic, revenue-generating work. This is more than a small efficiency gain. It’s a fundamental change in how you manage resources, leading to substantial cost reductions over time. For many firms, exploring automated data processing is the first step toward unlocking these savings.

Ultimately, this automation directly lowers the cost to serve each customer and process every transaction.

Boosting Accuracy and Reducing Risk

In finance, accuracy isn’t just important, it’s everything. A single misplaced decimal or an overlooked detail in a compliance check can have serious consequences. AI brings a level of precision that manual processes alone simply can’t match.

Once an AI model is trained to perform a task, whether it’s assessing loan risk or flagging compliance issues, it follows the exact same logic every single time. It never gets tired, distracted, or has an off day. This consistency dramatically reduces the chance of human error in critical areas.

AI acts as a safety net, ensuring that your core processes are executed with pinpoint accuracy. This not only improves efficiency but also strengthens your risk management framework, protecting your business from costly mistakes and regulatory penalties.

For instance, using tools like AI-powered financial insights dashboards provides real-time analytics, which sharpens decision-making and operational efficiency through far greater data accuracy.

Elevating the Customer Experience

Customers today expect service that’s fast, personal, and always on. AI makes it possible to meet and even exceed these expectations at scale, providing a level of support that was previously unimaginable.

Take AI-powered chatbots and virtual assistants. They give customers instant answers to their questions 24/7, without forcing them to wait in a call queue. This immediate help for common issues significantly improves satisfaction and loyalty.

But it goes beyond just support. AI helps you understand your customers on a much deeper level. By looking at their behaviour, it can offer personalised product recommendations and financial advice that feels genuinely helpful. This changes the relationship from purely transactional to a proactive and supportive partnership, creating a real competitive edge in a crowded market.

Navigating the Risks and Compliance Hurdles

Bringing AI into your operations is a big step, but it’s not just a matter of plugging in new software. Think of it like bringing on a new team member; you need to understand their limitations and have a plan for when things don’t go perfectly. Ignoring the potential pitfalls can create some serious headaches, from damaging customer trust to landing you in hot water with regulators.

Getting ahead of these risks is the key to building an AI strategy that’s not just powerful, but also responsible and compliant. It’s all about putting the right guardrails in place from day one.

The Problem of AI Bias

One of the most talked-about risks in AI in banking and finance is algorithmic bias. It’s a subtle but serious problem. Imagine training a new loan officer but only giving them files from a single, affluent postcode. They would naturally, and incorrectly, learn that this is what a “good” applicant looks like, potentially rejecting perfectly suitable candidates from elsewhere.

AI models are no different. They learn from the historical data we feed them. If that data reflects past biases, conscious or not, the AI will not only learn them, it can magnify them. This could result in a credit scoring model that unfairly disadvantages certain groups of people. That’s not just bad ethics; it’s a massive compliance risk.

The Black Box Dilemma

Another tricky issue is what’s known as the “black box” problem. Some of the most powerful AI models are so complex that even the data scientists who created them can’t pinpoint the exact reason behind a specific decision. The model might flag a transaction as fraudulent, but it can’t always show its working.

This is a non-starter for financial regulators in Australia, like the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC). They require that financial institutions must be able to explain their decisions, particularly for things like denying a customer a loan. If you can’t explain why your AI made a choice, you can’t prove you’re playing by the rules.

For regulators, a decision that can’t be explained is a decision that can’t be defended. The ability to look inside the AI’s “thinking” process isn’t just a technical nice-to-have; it’s a fundamental compliance requirement.

Protecting Customer Data

AI systems thrive on data. The more data they have, particularly for personalising customer experiences, the better they perform. But this immediately puts a spotlight on data privacy and security. You have a duty of care to protect your customers’ information, and introducing AI adds a new and complex layer to that responsibility.

Your data governance framework needs to be bulletproof, covering:

- Secure Storage: How and where customer data is kept safe from potential breaches.

- Ethical Use: Clear policies on what data can be used for training AI models and under what circumstances.

- Compliance with Laws: Rigid adherence to Australian privacy principles and financial regulations.

A data breach connected to an AI system could be devastating to your brand’s reputation and result in significant financial penalties.

A robust governance plan is non-negotiable for any organisation using AI in banking and finance. It’s the playbook that dictates how your teams will build, deploy, and manage these systems responsibly. It ensures you’re not just chasing the benefits of the technology, but also diligently managing its risks. For businesses that need a hand shaping this, working with experienced AI consultants can help build a framework that is both practical and compliant from the ground up.

A Practical Roadmap for AI Implementation

Getting started with AI in banking and finance, especially when you have older, established systems, can feel like a huge job. The good news is you don’t have to overhaul everything overnight. The smartest approach isn’t a giant leap but a series of deliberate, measured steps.

Think of it like renovating a house. You wouldn’t start by knocking down all the walls at once. Instead, you’d pick one room, like the kitchen, to modernise first. You prove the new design works, see the benefits, and then apply what you’ve learned to the rest of the house. Adopting AI in your organisation works in exactly the same way.

Start Small with a Pilot Project

The best way to begin is with a pilot project. This is a small-scale, controlled experiment designed to test a specific AI application within your business. The goal here is to prove the concept, iron out any kinks, and show real value before you commit to a company-wide rollout.

For example, you might choose to automate a single, high-volume process that’s currently slowing a team down. Perhaps it’s routing customer service emails or performing initial checks on loan applications. By starting here, you create a safe space to learn without disrupting your entire operation. A successful pilot builds momentum and gives you a powerful success story to share across the business.

A clear pilot helps you answer critical questions:

- Does the technology work as expected in our specific environment?

- What is the real impact on efficiency and accuracy?

- What resources and skills do we need to scale this up?

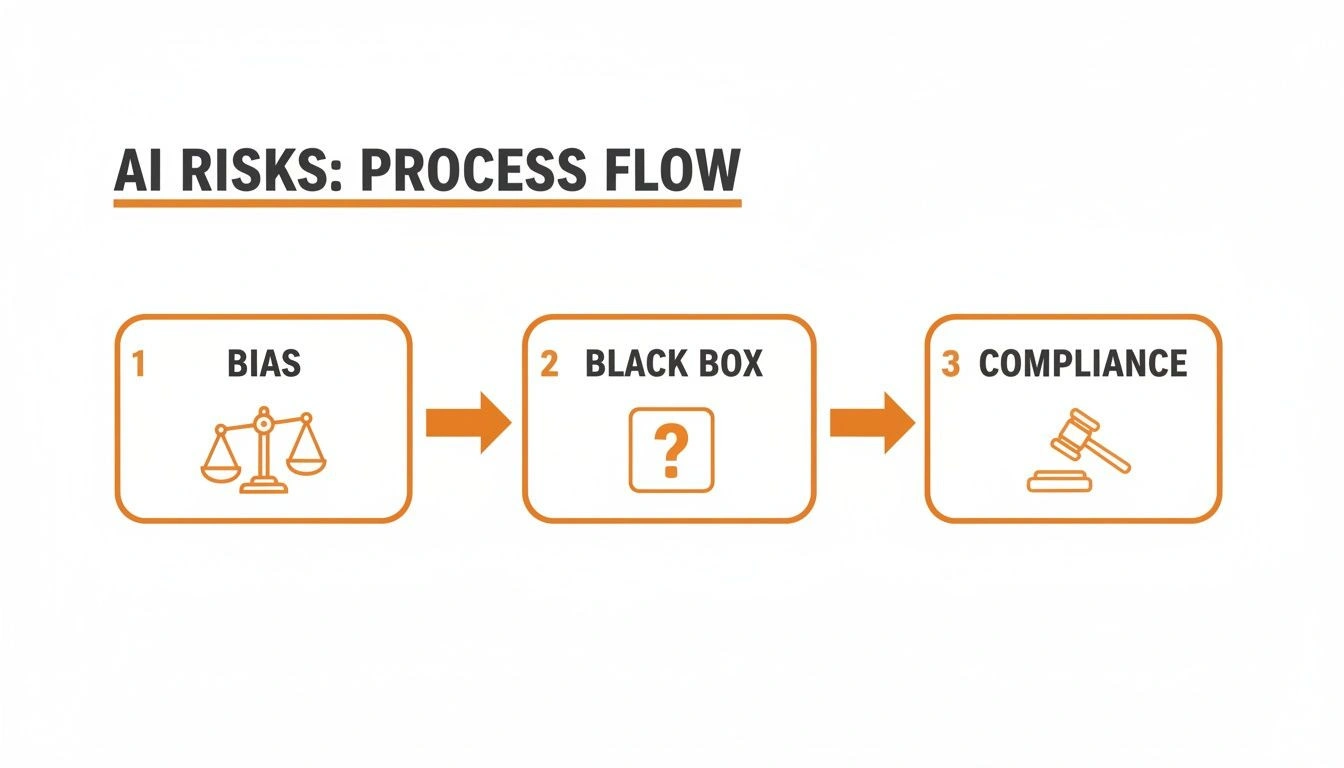

This process flow shows some of the key risks to consider as you design your pilot and overall strategy.

The diagram highlights how issues like data bias can lead to “black box” problems and, ultimately, compliance failures.

Build a Solid Data Strategy

Your AI is only as good as the data it learns from. If you feed it messy, incomplete, or biased information, you’ll get messy, unreliable results. It’s like trying to cook a gourmet meal with subpar ingredients; the final dish is never going to impress.

This is why a solid data strategy is not just important, it’s the foundation of your entire AI roadmap. Before you even think about algorithms, you need to get your data in order. This means knowing where your data lives, ensuring it’s clean and accurate, and having clear rules for how it’s managed and used.

A strong data governance framework acts as the blueprint for your AI initiatives. It ensures your data is secure, compliant, and ready to fuel intelligent systems, preventing the classic “garbage in, garbage out” problem.

This initial clean-up effort might seem tedious, but it pays off enormously in the long run. It makes implementing AI smoother and ensures the insights you get are trustworthy.

Choose the Right Technology and Partners

Once your data is in order and you have a successful pilot under your belt, the next step is thinking about scaling up. This involves choosing the right technology and, often, the right partners to help you. The market is flooded with AI tools, and it’s easy to get locked into a single provider’s ecosystem.

A vendor-agnostic approach is often the most sensible path. Instead of committing to one big platform, you select the best tools for each specific job. This gives you the flexibility to adapt as your needs change and technology evolves. It ensures the solution is shaped around your business problems, not the other way around.

Finding the right partner is crucial here. You need a team that understands both the technology and the unique challenges of the financial services sector. Good robotic process automation and AI experts will work with your existing systems, helping you integrate new tools without causing massive disruption. They focus on delivering measurable outcomes, ensuring your investment translates into real business value and long-term success.

Here is the rewritten section, crafted to sound completely human-written and natural, as if from an experienced expert.

Finding the Right Partner for Your AI Journey

Starting with AI in banking can feel a bit like setting out on a long road trip without a map. You know the destination, a more efficient, intelligent business, is worth it, but the path is complex and full of potential wrong turns. The good news is you don’t have to navigate it alone.

Working with the right partner can be the difference between a project that stalls and one that delivers real, measurable results. They act as your seasoned guide, helping you sidestep common roadblocks and ensuring your investment leads to tangible business gains, not just expensive experiments.

Bridging the AI Delivery Gap

Many organisations are discovering a hard truth: simply throwing money at AI doesn’t guarantee success. There’s a noticeable and often frustrating gap between the initial investment and the actual returns.

In fact, while 67% of Australian CEOs are planning to invest in technologies like AI, a surprisingly low 14% of local firms are reporting any revenue gains from it. That’s less than half the global average of 30%. According to PwC’s Australia CEO Survey, businesses waiting for the “perfect conditions” to get started will inevitably be left behind. It’s a clear signal that decisive action is needed.

This “AI delivery gap” is where so many well-intentioned projects fall apart. It happens when technology is purchased without a concrete plan for how it will connect with existing systems, solve a genuine business problem, and ultimately pay for itself.

A good partner helps you bridge this gap. They don’t just sell you a piece of software; they work with you to build a strategy that ties the AI solution directly to your core business goals.

The Value of Being Vendor-Agnostic

When you start looking for AI solutions, it’s easy to get pushed towards a single, all-in-one platform from a major tech provider. But your business isn’t a one-size-fits-all operation, and your technology stack shouldn’t be either.

A vendor-agnostic partner works differently. Think of them as an independent mechanic rather than a branded car dealership. The dealership will always recommend their own parts, even if a better or more affordable option exists elsewhere. The independent mechanic, on the other hand, will find the best possible part for your specific car and budget, regardless of the brand.

This approach gives you some crucial advantages:

- Best-of-Breed Tools: You get the right tool for each specific job, rather than being forced to use a single platform that’s a poor fit for certain tasks.

- Future-Proof Flexibility: It allows you to adapt and integrate new technologies as they emerge, without being locked into one provider’s ecosystem.

- Focus on Your Goals: The priority is solving your business problem, not selling you a particular product license.

It’s all about ensuring the technology is built around your needs, not the other way around.

Achieving Real Business Outcomes

At the end of the day, the goal of implementing AI in banking and finance is to achieve real-world outcomes. The right partner keeps this focus front and centre, moving beyond purely technical discussions to concentrate on what actually matters to your business.

This means building custom AI agents and automation that integrate seamlessly with the systems you already rely on. It’s about creating solutions that deliver measurable improvements, like lower operational costs, faster processing times, and a genuinely better experience for your customers. To see how a partnership can accelerate your journey and ensure a true return on investment, have a chat with our team of AI consultants.

Got Questions About AI in Finance? We’ve Got Answers.

It’s only natural to have questions when a technology as significant as AI begins to reshape an entire industry. Let’s tackle some of the most common queries we hear from leaders in the Australian finance sector.

Will AI Actually Replace People in Banking and Finance?

This is probably the number one question on everyone’s mind. The short answer is no, but it will change the nature of many roles. It’s less about replacement and more about a fundamental shift in focus.

Think of AI as a powerful new colleague, one that’s brilliant at sifting through mountains of data and handling the repetitive, time-consuming tasks. This frees up your human experts to concentrate on the high-value work that machines can’t do: building trusted client relationships, developing complex strategies, and making nuanced judgement calls. The machine provides the insight; the human provides the wisdom.

What’s the Real Cost of Implementing an AI Solution?

There’s no one-size-fits-all price tag here. The cost depends entirely on the scope and complexity of what you’re trying to achieve.

A smart way to start is with a targeted pilot project. This approach lets you test the waters and prove the technology’s value on a specific, measurable problem without a massive upfront investment. You can demonstrate a clear return, like significant cost reductions from automating a manual process, which then builds a strong business case for scaling up.

Can We Trust AI with Highly Sensitive Financial Data?

Security is non-negotiable in finance, and rightly so. A well-designed AI solution isn’t some rogue element operating in isolation; it functions within your existing, hardened security infrastructure.

It must adhere to the exact same stringent data privacy protocols and compliance standards as any other core system you run. The security isn’t a feature of the AI itself, but a foundational part of the governance, architecture, and processes you build around it. Partnering with the right experts ensures that compliance with Australian regulations is baked in from day one, not bolted on as an afterthought.

At Osher Digital, our expertise lies in turning AI’s potential into tangible business outcomes. We develop secure, practical automation and AI solutions designed to integrate seamlessly with the systems you already have. To see how we can tackle your specific challenges, have a chat with our expert AI consultants.

Jump to a section

Ready to streamline your operations?

Get in touch for a free consultation to see how we can streamline your operations and increase your productivity.