Unlocking Financial Reporting Automation in Australia

Discover how financial reporting automation transforms Australian businesses. Learn to implement automation for greater efficiency, accuracy, and compliance.

Let’s be honest, for too long, finance teams have been stuck in a cycle of chasing numbers. The end-of-month scramble to pull data, consolidate spreadsheets, and generate reports is a familiar headache. Financial reporting automation is about breaking that cycle. It uses smart technology to take over the repetitive, manual tasks, freeing your experts to focus on what truly matters: strategic analysis and driving business growth.

Think of it as giving your finance department a powerful co-pilot. Instead of manually flying the plane—inputting data, checking for errors, and navigating endless spreadsheets—your team can now oversee the flight path, interpret the data, and make crucial course corrections for the business.

What Is Financial Reporting Automation?

At its heart, financial reporting automation is about using specialised software to handle the end-to-end process of creating financial reports. It’s a move away from the old, error-prone world of manual data entry and juggling countless spreadsheets.

Instead of your team pulling information piece by piece from different systems, automation software acts as a central nervous system. It connects directly to your existing tools—like your accounting software, Enterprise Resource Planning (ERP) platform, or even your Customer Relationship Management (CRM) system. The software then automatically extracts the right data, organises it based on rules you set, and produces accurate, compliant financial statements with minimal human touch. This is a game-changer for reducing the human error that so often creeps into manual reporting.

From Manual Labour to Strategic Insight

The real magic of financial reporting automation isn’t just about speed; it’s about fundamentally changing the role of your finance department. Without it, finance professionals can spend the vast majority of their time on low-value, repetitive work. The reporting cycle becomes a frantic race against the clock, leaving almost no room for strategic thinking.

By taking over these foundational tasks, the technology gives your team back their most valuable assets: their time and their expertise. They can finally pivot from being data collectors to becoming true strategic analysts.

The goal is to evolve the finance function from a reactive scorekeeper of past events into a proactive, forward-looking business partner that steers decisions with timely and precise data.

This shift empowers them to focus on activities that create genuine, measurable value for the business.

Key Functions Handled by Automation

So, what exactly does this software do? Financial reporting automation platforms are built to handle the most common bottlenecks in a manual workflow. These core functions usually include:

- Data Aggregation: Automatically pulling financial data from multiple, disconnected sources—like different accounting ledgers, bank accounts, and sales systems—into a single, unified view.

- Data Consolidation: Seamlessly combining financial information from various business units, subsidiaries, or departments to give you a consolidated financial picture of the entire organisation.

- Reconciliation: Systematically cross-checking records from different sources (think bank statements versus your general ledger) to instantly flag any discrepancies, saving hours of manual ticking and tying.

- Report Generation: Automatically producing standard financial reports such as Profit and Loss (P&L) statements, balance sheets, and cash flow statements in a consistent, professional format.

- Compliance and Audit Trails: Ensuring all reports meet Australian accounting standards, like BAS and GST requirements, while also keeping a detailed log of every action for a smooth, transparent audit process.

By taking over these essential but time-draining duties, automation delivers a level of accuracy and speed that manual processes simply can’t match. Its rapid adoption across Australia is a direct answer to the growing demand for faster reporting and watertight compliance. For a closer look at the strategic advantages, check out this excellent resource on Financial Reporting Automation: Boost Your Strategy. This isn’t just an upgrade in efficiency; it’s about building a smarter, more resilient finance operation.

The Key Benefits of Automating Your Financial Reports

Moving to automated financial reporting isn’t just a minor upgrade; it’s a fundamental shift in how your business operates. It takes you from a state of constantly playing catch-up with your data to leading from the front with clear insights. The advantages are felt across the board—in your efficiency, accuracy, and strategic firepower.

The most immediate win is the sharp drop in human error. Let’s face it, manual processes are prone to mistakes. A simple typo, a broken formula, or a misplaced decimal can easily creep into a spreadsheet, and these small slip-ups can snowball, seriously damaging the credibility of your financial statements.

Automation puts a stop to that. By creating a system for data collection, consolidation, and calculation, it enforces consistency and removes the human element that causes these errors. The result? Financial reports you can actually trust for those big, make-or-break decisions.

Unlock Major Time and Cost Savings

Just think about the hours your finance team sinks into repetitive tasks every single month. Manually chasing down numbers, stitching together spreadsheets, and formatting reports is a huge drain on their time and your resources. Financial reporting automation tackles this inefficiency head-on.

By taking over these monotonous jobs, the technology frees up your skilled professionals to focus on work that really matters—like analysis, forecasting, and strategic planning. This isn’t just about making people happier; it has a direct impact on your bottom line.

- Reduced Labour Costs: With automation handling the grunt work, you spend less on manual data entry and processing.

- Increased Productivity: Your team can achieve more in less time, applying their expertise where it delivers real value.

- Faster Reporting Cycles: That frantic month-end close that used to take days, or even weeks? It can now be done in a fraction of the time.

This boost in efficiency allows your finance function to evolve from a cost centre into a true strategic partner for the business. To explore how this can be applied, you might be interested in our guide on how to automate your financial reporting for maximum impact.

Strengthen Regulatory Compliance and Reduce Risk

For any Australian business, keeping up with regulations is a constant and critical task. Staying compliant with requirements from the Australian Taxation Office (ATO), especially around Business Activity Statements (BAS) and Goods and Services Tax (GST) reporting, is simply non-negotiable.

Automation gives you a solid framework for compliance. The software can be set up to follow specific accounting standards and tax rules, making sure every report is generated correctly, every time. This is especially crucial for Australian SMEs that rely on software to manage local tax obligations. Leading systems automate GST calculations and help prepare BAS submissions, which dramatically minimises the risk of filing errors or late lodgements that attract hefty ATO penalties.

Automation creates a complete, unalterable audit trail. Every action, from data extraction to report generation, is logged, providing transparent and easily accessible documentation for internal reviews or external audits.

This level of built-in control and visibility significantly reduces your compliance risk.

Empower Strategic Decision-Making with Real-Time Data

Perhaps the most powerful benefit of all is how automation empowers your leadership team. Manual reporting is slow by nature. By the time executives see the final numbers, the data is already old news. It shows where the business was, not where it is right now.

Automation completely changes the game by providing access to real-time, or near-real-time, financial data.

With live dashboards that update continuously, leaders can monitor key performance indicators (KPIs) as they change. This single, up-to-the-minute view of the company’s financial health allows for faster, sharper strategic decisions. You can spot emerging trends, catch problems before they grow, and jump on opportunities with confidence. It transforms financial reporting from a backward-looking chore into a forward-looking strategic asset.

Understanding the Core Automation Technologies

To really get a handle on financial reporting automation, you first need to understand the technologies that make it all happen. These aren’t just fancy, high-speed calculators; they fundamentally change how we handle, analyse, and present financial data. Each piece of the tech puzzle has its own job, and when they work together, they create a remarkably intelligent system.

The first layer, and perhaps the most straightforward, is Robotic Process Automation (RPA). The best way to think of RPA is as a digital workforce. These software ‘bots’ are programmed to copy the repetitive, rule-based things a person does on a computer. They absolutely shine at structured tasks that follow the same predictable steps every single time.

For example, you could set up an RPA bot to log into your ERP each morning, pull the daily revenue figures from the sales ledger, and paste them into a specific cell in your master report. It’s a job a junior accountant could do, sure, but a bot does it in a fraction of the time, never needs a coffee break, and won’t ever make a typo. It’s the perfect solution for automating the high-volume, mind-numbing work that so often bogs down finance teams. We’ve covered this in more detail in our guide on RPA for finance.

Moving Beyond Repetition with AI and Machine Learning

While RPA is brilliant at following a script, Artificial Intelligence (AI) and Machine Learning (ML) bring a layer of smarts to the table. These technologies go way beyond just doing what they’re told. They analyse data, spot patterns, and make predictions or decisions based on what they’ve learned from that data.

- Artificial Intelligence (AI) is the big-picture concept of building machines that can reason and “think” like people. For finance, this means software that can understand context, read unstructured data (like the text on an invoice), and make a judgement call.

- Machine Learning (ML) is a key part of AI where the system actually gets better at its job over time without needing a developer to rewrite its code. It learns from history. An ML model, for instance, can sift through years of expense reports to learn what a “normal” claim looks like, making it incredibly good at flagging unusual or potentially fraudulent submissions that don’t fit the pattern.

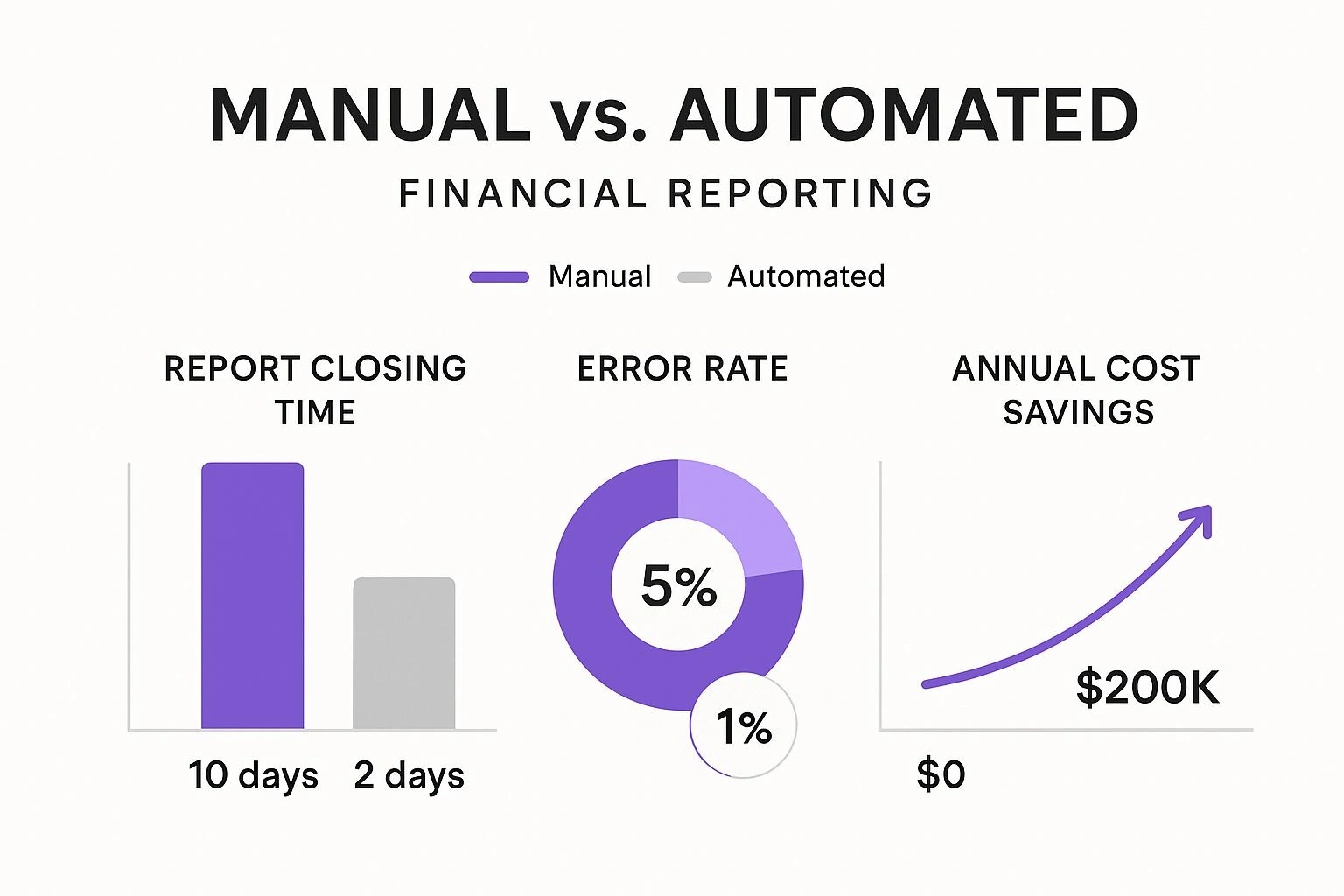

The difference automation makes compared to old-school manual methods is stark. This image really drives home just how much of an impact it can have on key metrics like closing times and accuracy.

The numbers speak for themselves. Automation can slash month-end closing times by as much as 80% and virtually eliminate the manual errors that creep into reports. Those are serious operational gains.

Comparing Key Automation Technologies in Finance

To clarify the roles these technologies play, it helps to see them side-by-side. RPA is your workhorse for repetitive tasks, while AI is your analyst, finding insights hidden in the data.

| Technology | Primary Function | Common Financial Reporting Tasks | Main Business Impact |

|---|---|---|---|

| Robotic Process Automation (RPA) | Mimics human actions to execute rule-based, repetitive processes. | Data entry, report generation, system reconciliation, invoice processing. | Increased speed, reduced manual errors, higher operational efficiency, frees up staff. |

| Artificial Intelligence (AI) | Analyses data, recognises patterns, and makes predictions or decisions. | Anomaly detection, predictive forecasting, natural language processing for analysis. | Deeper insights, improved risk management, enhanced strategic decision-making. |

This table shows how RPA and AI, while different, are complementary. One handles the “doing,” and the other handles the “thinking.”

Creating an Intelligent Financial Ecosystem

The real magic happens when these technologies team up. RPA can act as the data gatherer, pulling all the structured information from your different systems. This clean, organised data then gets fed into an AI or ML engine for much deeper analysis. It’s this combination that creates an intelligent financial ecosystem—one that gives you foresight, not just hindsight.

This shift moves financial reporting from a historical record-keeping exercise to a predictive, strategic function that anticipates future outcomes and informs critical business decisions.

This isn’t some far-off future, either. The transformation is already well underway in Australia’s accounting world. By 2025, the profession is expected to look profoundly different, with investment in AI tech projected to grow at a compound annual rate of 42.5% through 2027. We’re seeing tools automate things like intelligent data entry and fraud detection, and it’s paying off. Around 80% of Australian accounting firms now report higher demand for advisory services, an appetite fuelled by these new AI-powered insights.

The applications are spreading fast. For a look at how this is changing other specialised reporting areas, it’s worth exploring resources on AI for Sustainability Reporting. This synergy between different automation tools is exactly what gives a modern finance function its competitive edge.

A Practical Roadmap to Implementing Automation

Bringing financial reporting automation into your business isn’t just about buying a new piece of software and hoping for the best. It’s a journey that demands a thought-out, structured approach. To really get it right, you need to move methodically from planning and tool selection right through to implementation and ongoing fine-tuning.

A clear roadmap is what separates a successful transition from a disruptive and costly one. Each phase builds on the one before it, steering your organisation towards a finance function that’s more efficient, accurate, and ultimately, more strategic. Let’s walk through the four key stages.

Phase 1: Assessment and Planning

First things first: you can’t automate what you don’t understand. The starting line is a deep, honest look at your current financial reporting processes. Before you can even think about new tools, you need to know exactly what your team does now, where the delays and frustrations are, and which tasks are ripe for automation. Think of it as finding the low-hanging fruit.

Get your finance team in a room and map out your entire reporting workflow, from the first data entry to the final report. Where does everything grind to a halt? Are your accountants burning days manually reconciling intercompany transactions? Is consolidating data from different business units a monthly copy-paste marathon?

By pinpointing these high-pain, low-value activities first, you can focus your automation efforts where they will have the most immediate and visible impact. This builds momentum and demonstrates the value of the project early on.

This is also where you need to set clear goals. What does success look like? Are you aiming to slash your month-end close cycle by 50%? Is the main goal to eliminate data entry mistakes or to give leadership real-time financial dashboards? Having measurable objectives from the start will be your North Star for every decision that follows.

Phase 2: Selecting the Right Tools

Once you know what you want to automate, it’s time to figure out how. The market for financial automation software is crowded, so choosing the right platform is absolutely critical. Your decision should be anchored to the specific needs and goals you mapped out in the planning phase.

Don’t get dazzled by flashy features you’ll probably never touch. Instead, zoom in on the core criteria that matter for your business.

- Integration Capabilities: How well will the software talk to your existing tech stack? You need seamless integration with your ERP, accounting software, and any other critical systems. Anything less is a recipe for data silos and manual workarounds.

- Scalability: The tool needs to grow with you. A solution that fits your business today must also be able to handle more data, more users, and more complexity as you expand.

- User-Friendliness: Your finance team will live in this software, so it has to be intuitive. A clunky interface is a major barrier to adoption and will kill your return on investment.

- Vendor Support: What kind of support and training does the vendor offer? Solid customer service is invaluable, especially during the initial setup and for any troubleshooting down the line.

Draw up a shortlist and get your team involved in product demonstrations. This is their chance to see the software in a real-world context and ask sharp questions based on their daily headaches.

Phase 3: Implementation and Training

With your chosen tool in hand, it’s time to roll up your sleeves. This is where all that careful planning starts to pay off. For most businesses, a phased rollout works best. Start with those quick-win processes you identified earlier—this lets your team get comfortable with the new system on a smaller, manageable scale before you expand its use.

Getting your team on board is perhaps the most crucial part of this phase. You need to frame this change as an opportunity, not a threat. Make it clear that financial reporting automation is about getting rid of the tedious, repetitive work so they can focus on higher-value strategic analysis.

Proper training is non-negotiable for a smooth changeover. Your team needs hands-on instruction that’s tailored to their specific roles. A great tactic is to appoint a few ‘automation champions’ within the team who can act as go-to experts and cheerleaders for the new system.

Phase 4: Monitoring and Optimisation

Automating your financial reporting isn’t a one-and-done project. The final phase is a continuous loop of monitoring, reviewing, and optimising your new workflows. Your business is always evolving, and your automated processes need to evolve with it.

Keep a close eye on your performance metrics. Are you hitting the goals you set back in phase one? Have any new bottlenecks appeared? Use the analytics inside your new tool to track key indicators and spot areas for improvement.

This ongoing optimisation is where you truly maximise your investment. As your team gets more skilled with the platform, they’ll naturally find new ways to automate more tasks and refine existing workflows. By encouraging a culture of continuous improvement, you ensure your financial reporting automation strategy remains a powerful asset for years to come.

How to Overcome Common Implementation Challenges

Let’s be realistic: bringing new technology into a function as critical as finance is never without its challenges. Moving to financial reporting automation is a smart play, but a smooth transition hinges on knowing what hurdles to expect and having a strategy to clear them before they trip you up.

The most common roadblocks aren’t just technical. They’re about people, costs, and data security. If you get ahead of these issues, you’ll be in a much stronger position to see the real value from your investment right from the start.

Building a Business Case for the Initial Cost

The price tag on new software and implementation can feel like a steep hill to climb. The trick is to stop thinking of it as a cost and start framing it as a strategic investment with a clear and compelling return.

You have to build a business case that looks well beyond the initial invoice. Focus on quantifying the long-term financial wins in a few key areas:

- Direct Cost Savings: Start with the easy numbers. Calculate the hours your team currently sinks into manual reporting and put a dollar figure on that labour. Automation slashes these costs.

- Risk Reduction: Think about the potential cost of a compliance penalty from the ATO, or the financial fallout from a bad decision based on outdated numbers. Good automation directly minimises these expensive risks.

- Strategic Value: This one is a bit harder to pin down, but it’s often the most important. Highlight how real-time data gives your leadership the ability to make faster, smarter decisions that drive real growth.

When you present a solid analysis of these long-term gains, the upfront investment suddenly looks a lot more manageable.

Managing Employee Resistance and Change

It’s completely normal for people to get nervous when they hear the word “automation.” The fear of being replaced by technology is real and shouldn’t be dismissed. How you manage this human element is just as critical as getting the tech right.

The key is to change the story. This isn’t about replacing people; it’s about upgrading their roles. Financial reporting automation is a tool that frees your team from the grind of repetitive tasks, allowing them to focus on high-value analysis and strategy.

Think of it as giving your finance experts a digital assistant. The software handles the tedious, manual work, which frees up your skilled team to become the strategic advisors the business truly needs. This simple shift in perspective can turn apprehension into genuine enthusiasm.

Securing Your Sensitive Financial Data

Entrusting your financial data to a new system is a big deal, and security should be at the top of your list of concerns. Protecting this information isn’t an afterthought; it needs to be built into your implementation plan from day one.

Start by choosing a vendor who takes security as seriously as you do. You’ll want to see essentials like end-to-end data encryption, multi-factor authentication (MFA), and detailed audit trails that track every single action. Make sure they comply with recognised international security standards. Internally, you need to set up tight access controls. Define user roles and permissions so that staff can only see and touch the data they absolutely need to do their jobs.

Integrating with Legacy Systems

Finally, the reality for most businesses is a patchwork of old and new systems. Getting a modern automation tool to talk to an older ERP can be one of the trickiest parts of the puzzle. A new platform is only as good as the data it can get its hands on.

The solution is to bring your IT department and potential software vendors into the conversation early. Prioritise tools known for flexible integration capabilities and a proven track record of connecting with a wide range of systems. A focus on solid connectivity ensures you get a smooth flow of data across your entire tech stack, preventing new information silos from forming. You can explore more strategies for connecting different platforms by reading our article on business process automation.

Answering Your Key Automation Questions

Making the leap to automated financial reporting is a big move, and it’s natural to have questions. Business leaders and finance teams I speak with are always keen to understand the practical, on-the-ground impact of such a significant change. Let’s tackle some of the most common queries head-on to clear up any doubts.

Here are the straightforward answers to the questions that come up time and time again. My goal is to give you a solid understanding of how this technology will really affect your organisation.

Will Automation Replace Our Existing Finance Team?

This is usually the first question people ask, and it’s a fair one. The answer, however, is a firm ‘no’. The entire point of financial reporting automation is to empower your finance professionals, not to make them redundant.

Think about all the tedious, repetitive work that eats up your team’s day—things like manual data entry, reconciling accounts across different systems, or just formatting reports. Automation software is designed to take over that grunt work. By offloading these low-value tasks, you free up your accountants and analysts to do what you hired them for.

The real outcome here is a strategic evolution of roles. Your team members shift from being data processors to becoming high-value strategic partners. Their focus moves to proper financial analysis, complex forecasting, and uncovering the critical insights that drive better business decisions. Suddenly, their expertise is more essential than ever.

This transition allows them to apply their knowledge where it truly counts, turning the finance function from a reactive cost centre into a proactive driver of business performance.

Is Automation Only Suitable for Large Corporations?

It’s a common myth that sophisticated automation is only for big companies with deep pockets. While large corporations were certainly the first to jump on board, that’s simply not the reality anymore. The game has completely changed with the rise of accessible, cloud-based solutions.

Modern Software-as-a-Service (SaaS) platforms have made powerful automation tools both affordable and scalable for small and medium-sized enterprises (SMEs). Australian businesses, in particular, can now find platforms already built with local compliance needs in mind.

- Accessibility: Cloud-based tools mean you don’t need a massive upfront investment in servers and IT infrastructure.

- Scalability: Subscription models let you pay for what you actually use and easily scale up as your business grows.

- SME-Focused Features: Many of the best platforms offer robust automation for invoicing, bank reconciliation, and BAS/GST reporting, putting businesses of all sizes on a much more even playing field.

This widespread availability of technology means any business, regardless of its size, can now achieve the kind of accuracy and efficiency that was once reserved for corporate giants.

How Do We Ensure Our Financial Data Remains Secure?

When you’re dealing with sensitive financial information, data security is non-negotiable. Any reputable automation vendor knows this and builds their platform with security as a core foundation, not just an add-on. As you evaluate different tools, their security features should be at the top of your checklist.

You should be looking for solutions that offer a multi-layered defence. A few non-negotiables to demand include:

- End-to-end data encryption to protect your information whether it’s being sent or just sitting on a server.

- Multi-factor authentication (MFA) to stop unauthorised users from getting into your accounts.

- Comprehensive audit trails that create a clear record of every single action taken within the system.

On top of that, make sure any vendor you consider complies with recognised international security standards like ISO 27001 or SOC 2. Internally, you need to back this up with strong access controls, defining user roles so that staff can only see and interact with the data they absolutely need for their job.

What Is the Typical Return on Investment for Automation?

The return on investment (ROI) from financial reporting automation is about much more than just cutting costs. The value shows up in three main areas, delivering both concrete savings and strategic advantages.

First, you have the direct cost savings from the dramatic drop in manual labour hours. That one’s easy to see. Second is the huge value of mitigating risk. By minimising human error and keeping compliance consistent, you sidestep the potentially massive costs that come from reporting mistakes and penalties from regulatory bodies like the ATO.

The most profound return, though, comes from enabling better, faster strategic decisions. When your leadership team has access to real-time, trustworthy financial data, they can act decisively on new opportunities and get ahead of risks. This ability to drive long-term profitability and sustainable growth is where you’ll find the ultimate ROI.

Ready to move beyond manual processes and empower your finance team with intelligent automation? Osher Digital specialises in creating custom automation and custom AI development that unlock efficiency, improve accuracy, and drive strategic growth for your business. Discover how we can transform your financial reporting.

Jump to a section

Ready to streamline your operations?

Get in touch for a free consultation to see how we can streamline your operations and increase your productivity.