Unlocking Efficiency with Invoice Processing Automation

Discover how invoice processing automation transforms your finance operations. This guide covers key benefits, technologies, and implementation steps.

Let’s be honest, invoice processing can be a real headache. When you think about your accounts payable (AP) team, what comes to mind? For many, it’s an image of people swamped by piles of paper, manually keying in data, and endlessly chasing approvals. It’s a slow, tedious grind that’s ripe for mistakes and a major bottleneck for the entire business.

This is where invoice processing automation comes in. It’s about using smart technology, including Artificial Intelligence (AI), to take over the entire lifecycle of an invoice – from the moment it arrives to the final payment – with very little human touch. It’s a system built to automatically read, understand, and action your bills, transforming a chore into a strategic advantage.

From Paper Stacks to Strategic Advantage

Think about that traditional process for a moment. Every misplaced invoice or typo is a small cut, bleeding time and money from your bottom line. It’s not just inefficient; it’s a drain on your most valuable resource: your people.

Now, let’s paint a new picture. An invoice lands in an email inbox. Instantly, an automated system scans it, pulls out all the critical information (like the vendor, amount, and due date), checks it against the corresponding purchase order, and sends it to the right person for approval. This all happens in minutes, not days. That’s the core promise of invoice processing automation.

More Than Just Paying Bills Faster

But this isn’t just about speeding up payments. It’s about fundamentally changing the role of your finance department. The real goal is to free your team from the hamster wheel of repetitive data entry so they can focus on work that actually drives the business forward.

When you automate invoice processing, you give your team the two things they need most: time and data. This allows them to shift their focus to higher-value activities, such as:

- Financial Planning: Analysing spending patterns to find real cost-saving opportunities.

- Cash Flow Optimisation: Using real-time data on liabilities to make smarter, more informed financial decisions.

- Supplier Relationships: Paying vendors on time, every time, helps build stronger partnerships and gives you leverage to negotiate better terms.

Manual vs Automated Invoice Processing at a Glance

The difference between the old way and the new way is night and day. One is defined by paper, manual checks, and a high risk of error. The other runs on speed, precision, and intelligent workflows.

To see just how significant this shift can be, consider this: a study involving Uber showed that their AI-based system slashed manual invoicing work by half and cut the average time spent on each invoice by an incredible 70%. That’s a massive leap in efficiency.

This table breaks down the core differences in a simple way.

| Aspect | Manual Processing (The Old Way) | Automated Processing (The New Way) |

|---|---|---|

| Speed | Slow and cumbersome, often taking days or even weeks. | Extremely fast, with invoices often processed in minutes. |

| Accuracy | Prone to human errors like typos and duplicate payments. | Highly accurate thanks to automated data validation and checks. |

| Cost | High operational costs driven by labour and materials. | Lower operational costs and a much faster return on investment. |

| Visibility | Very limited; tracking an invoice’s status is difficult. | Complete, real-time visibility with a clear digital audit trail. |

| Strategic Value | Low. The focus is purely on administrative box-ticking. | High. It provides rich data for financial analysis and strategy. |

As you can see, adopting invoice processing automation is far more than a simple IT upgrade. It’s a strategic move that boosts efficiency, cuts down on risk, and lays the foundation for much smarter financial management.

The True Business Impact of Automating Invoices

Moving away from manual invoice handling is about much more than just speeding up payments. It’s a change that truly overhauls your financial operations from the ground up. The real value of invoice processing automation is seen in the tangible, measurable improvements it brings to your costs, efficiency, and accuracy. It’s about turning a tedious back-office chore into a real source of competitive advantage.

The most obvious and immediate win is a sharp drop in operational costs. Just think about everything that goes into a single paper invoice: printing, postage, physical storage, and—most importantly—the hours of staff time spent keying in data and checking details. Automation practically eliminates these direct costs overnight.

An automated system can process an invoice for a fraction of what it costs to do it by hand. This frees up a significant chunk of your budget, allowing you to reinvest it into growth instead of pouring it down the administrative drain.

Skyrocketing Operational Efficiency

Beyond the bottom-line savings, automation injects a new level of speed into your accounts payable workflow. Manual processes are notorious for delays caused by lost documents, chasing down approvals, and data entry backlogs. A cycle that might take weeks to clear can be crunched down to just a few hours or days.

This newfound speed sends positive ripples throughout the business. You can close your books faster, manage cash flow with more confidence, and consistently capture early payment discounts from suppliers—which is a direct boost to your profitability.

A finance team freed from the grind of manual invoice processing becomes a strategic asset. Instead of being data clerks, they become data analysts, focusing on financial forecasting, spend analysis, and identifying opportunities for greater fiscal discipline.

This shift empowers your team to contribute to the company’s bigger picture. They can move from reactively solving problems to proactively shaping financial strategy. Having this clear view of your business’s financial health is one of the key benefits of business automation that goes far beyond any single department.

Eradicating Costly Human Errors

No matter how sharp your team is, mistakes happen with manual data entry. It’s just human nature. A misplaced decimal, a wrong vendor code, or a duplicate payment can easily lead to serious financial losses and damage your relationships with suppliers.

Invoice processing automation acts as a powerful safety net against these expensive slip-ups. The technology runs several critical checks on its own:

- Data Validation: The system instantly cross-references invoice information with purchase orders and vendor files, flagging any mismatches.

- Duplicate Detection: It automatically spots and blocks duplicate invoices before they even get close to your payment system.

- Three-Way Matching: The platform can automatically perform a three-way match, confirming that the invoice, purchase order, and goods receipt note all line up perfectly before authorising payment.

Achieving this kind of precision manually, especially at scale, is next to impossible. The outcome is a more reliable and auditable financial record, which cuts down on risk and strengthens compliance.

Gaining Unprecedented Financial Visibility

Finally, one of the most powerful impacts of automation is the sheer clarity it brings. With manual systems, finance leaders are often flying blind, with very little real-time insight into upcoming liabilities or cash flow.

Automated systems, on the other hand, offer dynamic, live dashboards that give you a complete picture of your accounts payable pipeline. You can see exactly which invoices are waiting for approval, which are ready to go, and what your payment obligations look like at any given moment.

This level of financial intelligence is crucial. It gives you the solid data you need for accurate forecasting, smart strategic planning, and making nimble business decisions.

How the Technology Actually Works

To really get a handle on invoice processing automation, it helps to pop the bonnet and see what makes it tick. Think of it like a highly skilled digital mailroom clerk—one that doesn’t just read documents, but actually understands them and knows what to do next. This whole process is driven by a trio of technologies working together seamlessly.

This digital expert doesn’t get tired, doesn’t make typos, and certainly doesn’t need a coffee break. It uses a combination of smart software to build a smooth, intelligent workflow that completely changes how invoices are managed, from the moment they arrive to the final payment.

Let’s break down the core components.

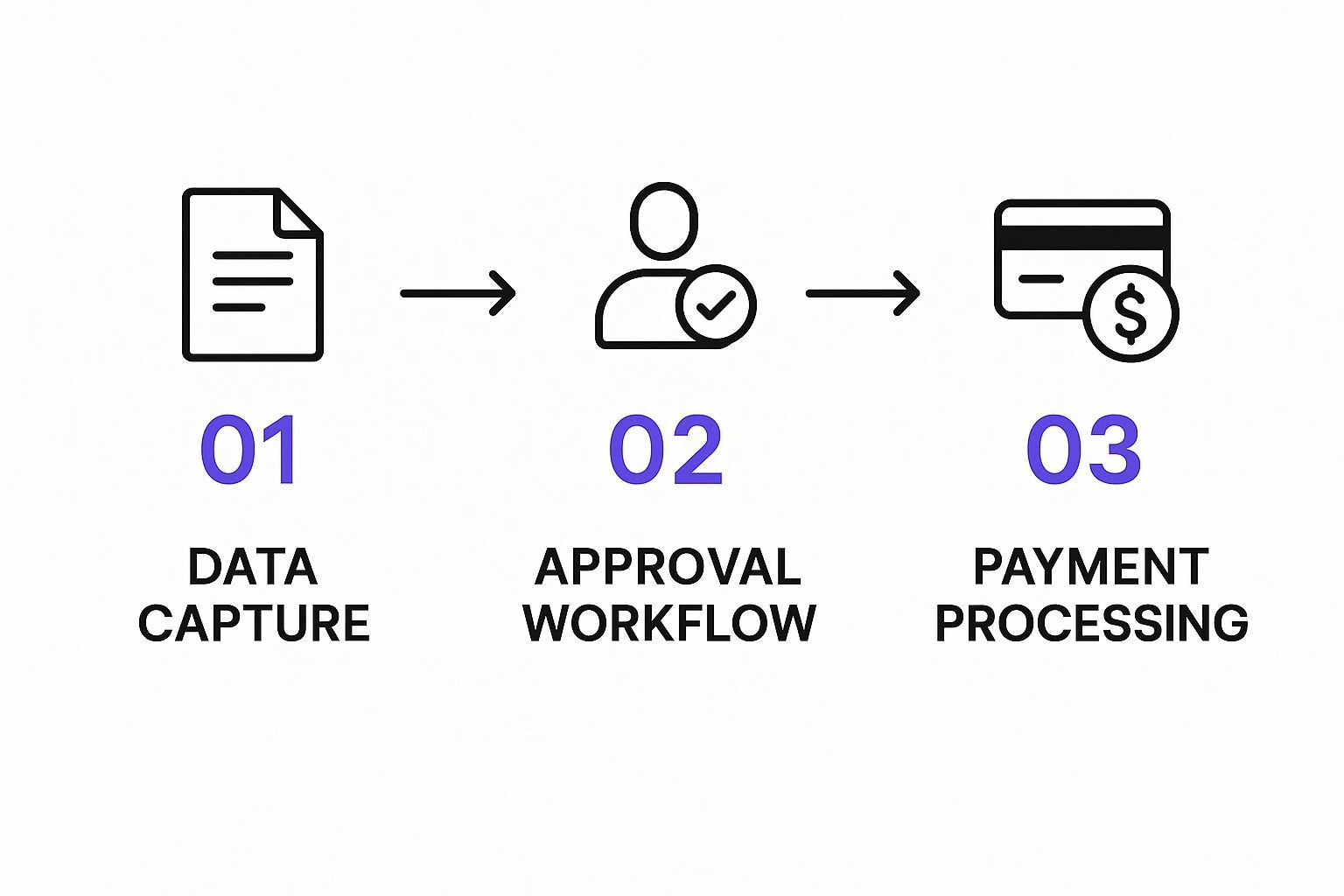

The infographic below shows how this all flows together, from capturing the initial data to getting approvals and processing the payment.

As you can see, automation forges a clear, organised path for every single invoice, replacing the often chaotic and unpredictable nature of doing it all by hand.

The Eyes of the Operation: Optical Character Recognition

The first job in any invoice processing automation workflow is to lift the data off the page. This is where Optical Character Recognition (OCR) steps in. You can think of OCR as the system’s “eyes.” It scans an invoice—whether it’s a PDF, a paper document, or even a photo from a phone—and turns the pictures of letters and numbers into digital text that a computer can work with.

But modern systems go a step further than basic OCR. They often use a smarter technology called Intelligent Document Processing (IDP). IDP doesn’t just see the text; it understands its meaning. It knows that “123 Main Street” is a delivery address and that “$549.95” is the total due, even if those details are in completely different spots on invoices from different suppliers.

The Brain: Artificial Intelligence and Machine Learning

Once the data has been extracted, the “brain” of the operation gets to work. This is where Artificial Intelligence (AI) and Machine Learning (ML) come into play, taking the system from a simple data-entry tool to a smart decision-making partner.

This is what the AI is responsible for:

- Data Validation: The system checks the extracted details against your existing records, like purchase orders or supplier lists, to make sure everything lines up correctly.

- Exception Handling: If it spots a problem—maybe a price doesn’t match the PO, or a PO number is missing altogether—it flags the invoice for a human to look at, rather than just pushing a mistake further down the line.

- GL Coding: With time, ML algorithms start to recognise your general ledger coding habits. They’ll begin suggesting the right codes for you, and can eventually even apply them automatically, saving your accounts team a huge amount of manual work.

This intelligent layer is what truly sets modern automation apart from older, more rigid systems. It learns and adapts on the fly, getting smarter and more precise with every invoice it handles.

The Hands: Robotic Process Automation

After the OCR has read the data and the AI has verified it, Robotic Process Automation (RPA) acts as the system’s tireless “hands.” RPA uses software ‘bots’ that are programmed to handle all the repetitive, rules-based tasks that people used to get bogged down with.

These bots take the approved and validated invoice information and execute the final steps. For instance, an RPA bot can automatically punch the data into your Enterprise Resource Planning (ERP) or accounting software, send the invoice to the right manager for a final sign-off, and even schedule the payment once it gets the green light.

By combining OCR, AI, and RPA, invoice processing automation creates a complete, end-to-end workflow. It’s a powerful synergy where each technology handles the part of the process it’s best at, from reading and understanding to acting and recording.

This technological momentum is clear here in Australia. By 2025, the uptake of AI-powered tools has already reshaped how accounts payable departments function. Intelligent systems are now automating data extraction with incredible accuracy, which dramatically cuts down on errors like duplicate payments. They also route invoices to the correct approvers based on predefined rules. These capabilities don’t just improve efficiency; they strengthen fraud detection by flagging suspicious patterns in real time, as detailed in recent industry analysis. You can find more insights on these top accounts payable trends on serrala.com.

Your Step-by-Step Implementation Plan

Successfully implementing invoice processing automation isn’t an overnight affair. It’s not about flicking a switch and watching the magic happen. Instead, it’s a strategic journey that requires a thoughtful, phased approach to move your organisation from its current state to a much more efficient, automated future.

This journey starts not with choosing software, but with a deep dive into your existing processes. A methodical plan ensures you’re solving the right problems, selecting the best tools, and, most importantly, bringing your team along for the ride.

Stage 1: Assess Your Current AP Process

Before you can even think about improving your accounts payable workflow, you need to understand it inside and out. This means mapping every single step, from the moment an invoice lands on someone’s desk (or in an inbox) to the final payment and archival. The real goal here is to pinpoint the exact bottlenecks and pain points that are costing you time and money.

To guide this assessment, you need to ask some hard questions:

- Where do invoices constantly get stuck in limbo?

- How much time is your team really spending on manual data entry for each invoice?

- How often are you dealing with costly errors like duplicate payments or data entry mistakes?

- What’s the average time it takes for an invoice to get approved, from start to finish?

Answering these questions gives you a solid, data-backed baseline. It provides a tangible starting point to measure the impact of automation and helps you build a compelling business case for the investment.

A thorough process audit is the bedrock of any successful automation project. It shifts the conversation from a vague complaint like “our AP is slow” to a specific, measurable problem like, “invoice approvals for project-based expenses take an average of 14 days because of manual routing.”

Stage 2: Set Clear Objectives And KPIs

Once you know exactly where the problems lie, you can define what success will actually look like. This is where you set clear, measurable objectives, often called Key Performance Indicators (KPIs). These KPIs become your North Star, guiding the project and helping you demonstrate a clear return on investment (ROI).

Your KPIs should be a direct response to the pain points you uncovered in your assessment. Common goals we see clients set include:

- Reduce invoice processing costs by a specific target, like 50%.

- Slash the average invoice approval time from weeks to just a few days (e.g., from 10 days down to 3).

- Completely eliminate late payment fees within the first six months of going live.

- Boost data accuracy to over 99%, drastically cutting down the need for manual corrections.

These concrete targets transform your project from a vague idea into an actionable plan with undeniable success metrics. For a closer look at this stage, our step-by-step guide to automating invoice processing with RPA offers more detailed insights.

Stage 3: Engage And Train Your Team

Here’s a truth many organisations learn the hard way: technology doesn’t deliver results, people do. One of the biggest hurdles to any automation project is navigating the human side of change. It is absolutely crucial to communicate openly and honestly with your AP team right from the beginning.

You need to explain why this change is happening, focusing on how it benefits them directly—less soul-crushing data entry, more time for valuable strategic analysis, and a chance to develop new skills. Proper training isn’t just a nice-to-have; it’s non-negotiable. Your team must feel confident and capable with the new system.

A solid change management plan involves communicating the “what” and the “why,” delivering comprehensive training, and creating a support system for the transition. This proactive approach helps turn potential resistance into enthusiastic adoption, ensuring the people who use the system every day are its biggest champions.

Choosing the Right Automation Software

Selecting the right software for automating your invoice processing is one of the most critical decisions you’ll make. The market is absolutely flooded with options, from small, single-task tools to sprawling financial platforms. The real trick is to look past the slick marketing and zero in on the criteria that will actually deliver long-term value and a solid return on your investment.

Think of it like choosing a new vehicle for your business. A zippy sports car looks great, but it’s useless for hauling equipment. A heavy-duty truck is powerful, but it’s overkill and inefficient for making a few city deliveries. The “best” vehicle depends entirely on what you need to do, and the exact same logic applies here.

Aligning Software with Your Business Reality

Before you even look at a demo, the first step is to hold up any potential software against the unique reality of your own operations. A solution that’s a game-changer for a small e-commerce store will almost certainly fall flat for a large construction firm.

Your evaluation needs to be grounded in three practical areas:

- Business Size and Invoice Volume: How many invoices are you actually processing each month? A small business juggling a few hundred has vastly different needs than an enterprise wrestling with thousands across multiple departments. Some platforms are built and priced for high-volume work, while others are a more sensible entry point for smaller teams.

- Industry-Specific Needs: Does your industry have unique invoicing quirks? Think about project-based billing in construction or the batch processing common in manufacturing. Certain software is specifically designed for these workflows. For tradies, for example, linking every invoice back to a specific job and its materials is non-negotiable. Our guide on business process automation for trade businesses dives deeper into these specialised needs.

- Existing Technology Stack: Whatever you choose, it has to play nicely with the systems you already rely on. Is your accounting software in the cloud, like Xero, or are you running a more complex on-premise ERP like SAP? Seamless integration is non-negotiable. Otherwise, you’re just creating new data headaches and manual workarounds, which defeats the whole purpose.

Key Evaluation Criteria Beyond the Feature List

It’s easy to get distracted by a long list of shiny features, but the most important qualities of an automation platform are often the less glamorous ones. When you’re comparing your shortlist, these are the factors to prioritise.

Scalability isn’t just about handling more invoices as you grow. It’s about the software’s ability to adapt to more complexity—new payment types, additional company entities, or changing compliance rules—without forcing you to rip everything out and start over.

The Australian market is a great example of this diversity. By 2025, local businesses have access to a fantastic range of solutions designed for their specific scale and requirements. Platforms like Airwallex Bill Pay, for instance, offer an all-in-one environment to upload, approve, pay, and reconcile invoices, handling global payments and using AI-driven OCR to speed things up. On the other hand, systems like Sage Intacct are geared towards medium-sized businesses that need deeper financial and payroll insights alongside their automation.

This is what a modern dashboard often looks like, giving you a central command centre for all your invoices.

This kind of clear, visual interface lets finance teams spot bottlenecks and manage their workload at a glance—a world away from the old days of digging through overflowing inboxes and spreadsheets.

Finally, don’t ever overlook vendor support and security. You need to be sure the provider has robust data protection protocols that comply with Australian privacy laws. A responsive and knowledgeable support team is also worth its weight in gold, especially when you’re getting set up and finding your feet. A thoughtful choice based on these core criteria is what will set your business up for genuine, long-term success with automation.

Common Questions About Invoice Automation

Whenever a business considers changing a core process like invoicing, questions are bound to come up. It’s completely normal. Shifting from a system you know—even if it’s slow and manual—to an automated one is a big step.

Leaders want to be sure about how it all works, what it will really cost, and if their data will be safe. Getting straight answers to these common concerns is the best way to move forward with confidence. Let’s dig into the questions we hear most often.

How Long Does Implementation Take?

Many people assume that bringing in automation will be a massive, disruptive project that drags on for months. While that might have been true years ago, modern cloud-based solutions are surprisingly fast to deploy.

For most businesses, you’re typically looking at a matter of weeks, not months. The timeline really comes down to a few key factors:

- System Integrations: How many systems do we need to connect to? Hooking into your existing ERP or accounting software is standard, but the complexity can vary.

- Level of Customisation: Are you after standard workflows, or do you need highly specific, bespoke business rules? The more tailored the solution, the more time is needed for setup.

- Rollout Strategy: We often recommend a phased approach. Starting with one department or a single type of invoice lets you get up and running quickly, score an early win, and learn as you go.

Is Automated Invoice Processing Secure?

This is a big one, and rightly so. The short answer is yes, absolutely. In fact, a well-designed automated system is far more secure than handling paper invoices or PDF attachments over email.

Think about it: physical documents can get lost, left on a desk for anyone to see, or misfiled with no real record of who touched them. Reputable invoice automation platforms are built with security as a foundation, not an afterthought. They use multiple layers of protection to guard your financial data.

This includes things like:

- Data Encryption: All your information is scrambled and unreadable, both when it’s being sent and when it’s stored.

- Role-Based Access Controls: This ensures people can only see or approve the invoices that are relevant to their job. No more, no less.

- Detailed Audit Trails: Every single action—from the moment an invoice arrives to when it’s paid—is logged in a permanent, unchangeable record.

By digitising and securing the entire workflow, automation removes many of the vulnerabilities inherent in manual processes. It provides a level of traceability and control that is simply impossible to achieve with paper and email chains.

Can It Handle Complex Invoices?

Yes, it certainly can. The first generation of automation tools was quite rigid and struggled with anything that didn’t fit a perfect template. Today’s systems, however, are powered by Artificial Intelligence and are specifically built to handle the messy reality of real-world invoices.

These platforms can easily process multi-page documents, invoices with hundreds of line items, or those with different currencies and tax codes. The key is the machine learning engine. It learns the layout of a new supplier’s invoice the first time it sees it, and gets smarter with every document it processes. Over time, it can find and pull data from even the most unusual formats without a human needing to step in.

What Is the Typical Return on Investment?

The ROI for invoice processing automation is one of the most compelling parts of the story. Most businesses see a full return on their investment within 6 to 18 months.

This return comes from two places. First, there are the hard cost savings you can easily measure: less manual labour, no more printing or physical storage costs, and the end of penalties for paying late. Capturing early payment discounts—which are often missed in manual systems—can by itself deliver a huge, immediate boost to your bottom line.

Then you have the softer, but equally important, benefits. Things like massively improved data accuracy, faster month-end closing, and most importantly, freeing up your finance team from tedious data entry to focus on high-value, strategic work.

Ready to get answers to your own questions about automation? The experts at Osher Digital can help you analyse your current processes and build a solid business case for making the switch. We design and implement solutions that deliver real, measurable results in efficiency and cost savings. Discover how we can help your business scale.

Jump to a section

Ready to streamline your operations?

Get in touch for a free consultation to see how we can streamline your operations and increase your productivity.