7 Vendor Management Best Practices for 2025

Elevate your strategy with our roundup of 7 vendor management best practices. Discover actionable insights for risk, performance, and contract optimisation.

Managing vendor relationships directly impacts an organisation’s operational efficiency, financial health, and strategic agility. Moving beyond simple transactional interactions to build robust partnerships requires a structured, strategic approach. This involves more than just negotiating prices – it’s about systematically managing performance, mitigating risks, and fostering collaboration to unlock mutual value.

The right practices can transform your vendor portfolio from a mere cost centre into a significant source of innovation and competitive advantage. For example, while general principles apply broadly, their application can be highly specialised. To see how these principles apply to specific industries, consider exploring Top Vendor Management Best Practices for Telecom. Adopting a disciplined framework ensures the selection of optimal technologies and processes tailored to your specific business needs.

This guide details seven fundamental vendor management best practices, offering a comprehensive blueprint for creating a resilient, high-performing supplier ecosystem. Each practice provides actionable steps to refine your approach, ensuring your organisation maximises the value from every vendor partnership and is prepared for future challenges. We will cover everything from strategic segmentation and risk assessment to performance management and contract optimisation, providing a clear path to elevate your vendor relationships.

1. Strategic Vendor Segmentation and Classification

A one-size-fits-all approach to vendor management is inefficient and exposes an organisation to unnecessary risk. Strategic vendor segmentation is a foundational practice that involves systematically categorising suppliers based on their strategic importance, risk profile, and overall business impact. This allows you to allocate management resources precisely where they are needed most, moving beyond a purely spend-based analysis.

By creating a tiered classification system, you can tailor your governance, relationship management, and performance monitoring efforts. This ensures that your most critical partners receive the highest level of executive attention and collaborative planning, while transactional suppliers are managed efficiently with minimal overhead.

How to Implement Vendor Segmentation

To effectively implement this vendor management best practice, start by defining clear criteria for each tier. This process should involve cross-functional stakeholders from procurement, finance, operations, and IT to ensure a holistic view of each vendor’s contribution and potential risk.

- Critical/Strategic Tier: These are high-impact, high-risk vendors whose services are integral to your operations. They are often difficult to replace and require deep integration and executive-level relationships. Think of a core technology provider like Microsoft or a critical raw material supplier in a manufacturing line.

- Important/Preferred Tier: These suppliers are significant to your business but pose a moderate risk and are more easily substitutable. Management involves regular performance reviews and relationship management, but not the same intensity as the critical tier.

- Tactical/Transactional Tier: This tier includes vendors for low-value, low-risk goods and services, such as office supplies or standard components. The focus here is on procurement efficiency and cost control, often through automated systems.

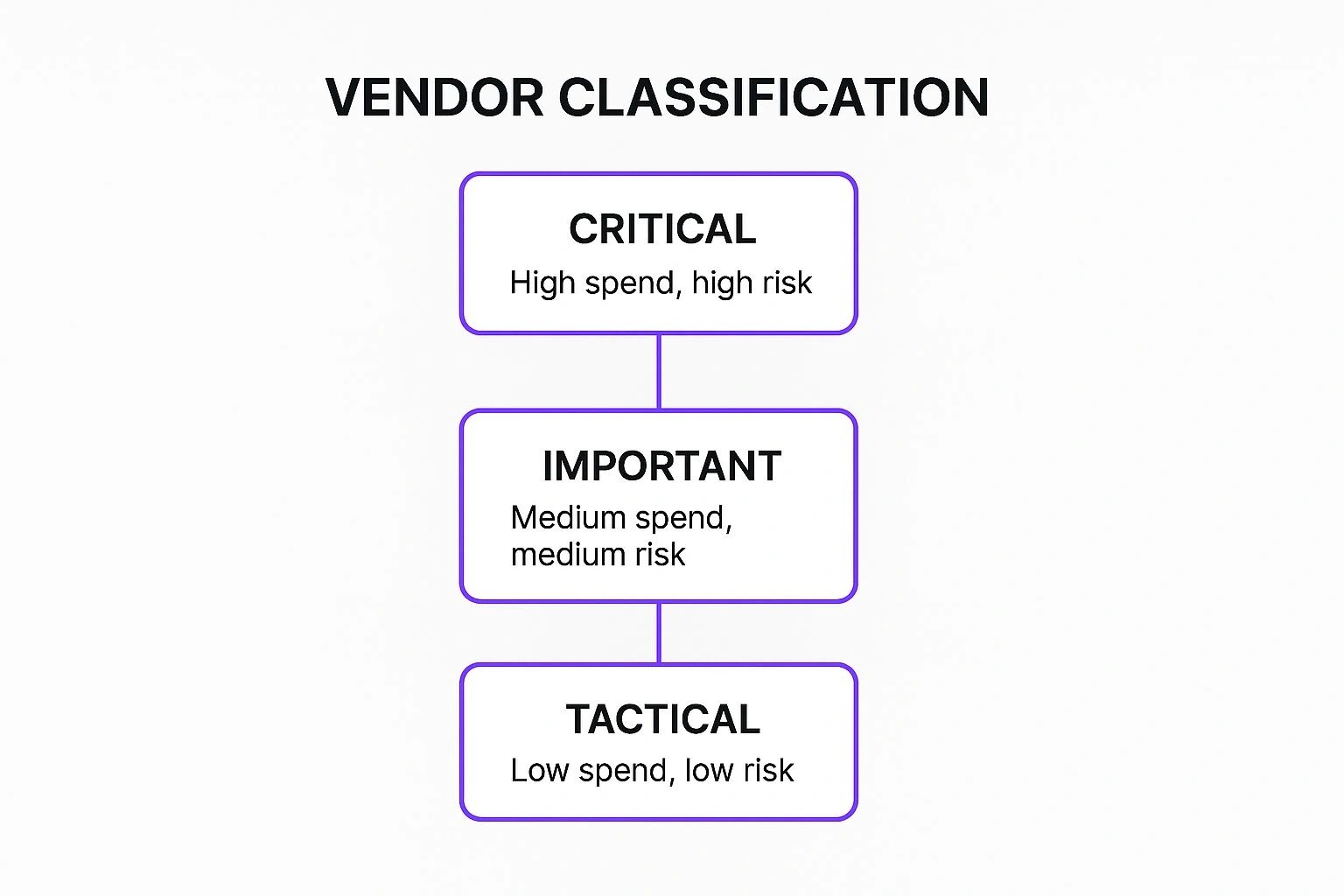

The following infographic illustrates a common three-tiered hierarchy for vendor classification.

This hierarchy visually represents how management focus and resources should be distributed, with the most critical vendors at the top receiving the greatest attention. Implementing such a model, similar to those used by global giants like General Electric and Walmart, transforms vendor management from a reactive, administrative task into a strategic, value-driven function. Regularly review and update these classifications (at least annually) to reflect changes in your business needs and market dynamics.

2. Comprehensive Vendor Risk Assessment and Monitoring

Simply onboarding a vendor is not the end of the risk management process; it is the beginning. A core component of vendor management best practices involves a continuous cycle of identifying, evaluating, and monitoring the diverse risks tied to your supplier relationships. This extends beyond initial due diligence to encompass the entire vendor lifecycle, ensuring potential threats are managed proactively rather than reactively.

This comprehensive approach involves assessing financial stability, operational resilience, cybersecurity posture, and regulatory compliance. By embedding risk assessment into your standard procedures, your organisation can mitigate disruptions, protect sensitive data, and maintain operational integrity. It transforms risk management from a compliance checkbox into a strategic advantage, safeguarding your business against the ripple effects of a vendor failure.

How to Implement Vendor Risk Assessment

Effective implementation requires a structured framework that is both rigorous and adaptable to different vendor types. This process should be integrated from the initial sourcing stage through to contract termination, with clear ownership and escalation paths defined.

- Initial Due Diligence: Before signing a contract, conduct a thorough assessment covering key risk domains. This includes financial health checks (e.g., credit scores, financial statements), cybersecurity evaluations (e.g., security audits, penetration test results), and operational capability reviews (e.g., business continuity and disaster recovery plans).

- Ongoing Monitoring: Risk profiles are not static. Implement continuous monitoring, especially for strategic and important vendors. Use automated tools to track financial health indicators, public filings, and adverse media mentions. Schedule regular cybersecurity and compliance reassessments to ensure standards are maintained. For more insights into the data integrity aspect of this process, you can explore detailed strategies for data quality management.

- Tiered Assessment Frequency: Not all vendors require the same level of scrutiny. Align the frequency and depth of your risk assessments with your vendor segmentation tiers. Critical vendors may require quarterly or even monthly reviews, while transactional suppliers might only need an annual check-in.

This systematic approach is exemplified by major financial institutions like JPMorgan Chase, which employ robust third-party risk management programs to meet strict regulatory demands. Similarly, following its 2013 data breach, Target significantly enhanced its vendor cybersecurity assessment program, creating a benchmark for the retail industry. By adopting a similar, structured methodology, organisations can build a resilient and secure supply chain, turning a potential vulnerability into a source of competitive strength.

3. Performance Management Through SLAs and KPIs

Establishing clear, measurable performance standards is a cornerstone of effective vendor management. Without them, performance becomes subjective and governance lacks teeth. A structured approach using Service Level Agreements (SLAs) and Key Performance Indicators (KPIs) formalises expectations, creates accountability, and provides a data-driven foundation for managing vendor relationships.

This practice transforms the relationship from a simple transaction into a managed partnership focused on achieving specific, mutually understood business outcomes. It ensures that both your organisation and the vendor have a precise definition of what “good performance” looks like, backed by objective metrics.

How to Implement Performance Management

To build a robust performance framework, you must align vendor KPIs directly with your strategic business objectives. This ensures that vendor activities contribute directly to organisational goals, rather than existing in a vacuum. The process involves defining the metrics, setting targets, and establishing a regular cadence for review and feedback.

- Define SLAs and KPIs: Work collaboratively with the vendor to define specific, measurable, achievable, relevant, and time-bound (SMART) KPIs. For a cloud service provider, this might include uptime percentage (e.g., 99.95%), data retrieval speed, and security incident response time.

- Establish a Reporting Cadence: Implement regular performance reviews, such as monthly or quarterly business reviews (QBRs). Companies like Ford Motor Company use rigorous QBRs to assess supplier performance against scorecards, discuss challenges, and align on future goals.

- Link Performance to Consequences: An SLA should have clear consequences for both meeting and failing to meet targets. This could include service credits or financial penalties for underperformance and performance bonuses or contract extensions for exceeding expectations. For a deeper dive into effectively tracking whether your service expectations are being met, you can refer to a comprehensive guide on Service Level Agreement Monitoring.

Organisations like Amazon have perfected this by using detailed vendor scorecards that track on-time delivery, order defect rates, and customer feedback. This system automatically flags underperforming suppliers, enabling proactive issue resolution. By implementing similar performance management mechanisms, you create a transparent and high-performing supplier ecosystem, making it a crucial component of modern vendor management best practices. The principles behind setting these targets are similar to those used internally; you can discover more about defining effective key performance indicators to strengthen your overall approach.

4. Centralised Vendor Information Management System

Disparate vendor data stored across spreadsheets, email inboxes, and disconnected departmental systems creates inefficiency and elevates risk. Implementing a centralised vendor information management system is a crucial best practice that establishes a single, authoritative source for all supplier-related data, documentation, and activities. This unified platform provides stakeholders across the organisation with consistent, real-time vendor information.

By centralising master data, contracts, performance scorecards, risk assessments, and communication logs, you enable far better coordination and strategic decision-making. This system transforms vendor management from a fragmented, siloed function into a transparent and cohesive process, ensuring everyone works from the same, accurate information.

How to Implement a Centralised System

Successfully deploying a vendor management system requires careful planning, focusing on data integrity and user adoption. The goal is to create a seamless flow of information that integrates with your existing enterprise architecture, rather than adding another isolated tool.

- Phased Rollout: Begin by centralising core vendor master data, such as contact details, tax information, and banking details. Gradually expand the system’s scope to include contract management, performance dashboards, and risk-profiling modules.

- Data Governance: Establish and enforce strong data governance policies from the outset. Define ownership, standards, and validation rules to maintain data accuracy and integrity. Implement regular data cleansing processes to remove obsolete or incorrect information.

- System Integration: For maximum impact, integrate the platform with existing enterprise systems like your ERP (Enterprise Resource Planning), financial software, and procurement tools. This ensures a seamless data flow and eliminates manual data entry.

- User Training and Adoption: Provide comprehensive training and ongoing support for all users, including vendors who may use a supplier portal. Showcasing the benefits and making the system user-friendly are key to driving adoption.

Global organisations like Coca-Cola utilise centralised supplier portals to standardise vendor interactions and data management worldwide, while platforms from providers like SAP Ariba and Coupa have popularised this integrated approach. By creating a single source of truth, you equip your organisation to manage vendor relationships more effectively, mitigate risks proactively, and unlock greater strategic value.

5. Structured Vendor Onboarding and Due Diligence Process

Engaging a new vendor without a formalised evaluation process is a significant business risk. A structured vendor onboarding and due diligence process provides a standardised framework for assessing, qualifying, and integrating new suppliers. This ensures that every potential partner is thoroughly vetted against key criteria before any contracts are signed, safeguarding your organisation from financial, operational, and reputational damage.

This systematic approach moves beyond a simple price comparison to a holistic evaluation of a vendor’s capabilities and stability. It involves checks on financial health, legal and regulatory compliance, operational capacity, and cybersecurity posture. Implementing this as one of your core vendor management best practices establishes a consistent, defensible method for selection and mitigates risk from the very beginning of the relationship.

How to Implement a Structured Onboarding Process

To build a robust onboarding and due diligence workflow, you must define the stages and stakeholders involved clearly. This is not just a procurement task; it requires input from legal, finance, IT, and the specific business unit that will use the vendor’s services. An integral part of this is understanding the nuances of conducting effective due diligence to uncover potential issues early.

- Create Tiered Onboarding Tracks: Not all vendors require the same level of scrutiny. Develop different onboarding paths based on the vendor’s strategic importance and risk profile, similar to the segmentation model. A critical software provider will undergo a much more intensive review than a supplier of office catering.

- Automate and Standardise: Use digital intake forms, automated workflows, and a central system to manage the process. This reduces manual effort, prevents steps from being missed, and creates a clear audit trail. For more insights, you can explore some process documentation best practices.

- Establish and Communicate Timelines: Set clear expectations for both internal teams and prospective vendors regarding the timeline for evaluation and onboarding. This transparency prevents delays and demonstrates professionalism.

- Maintain a Pre-Qualified Vendor List: For frequently sourced goods or services, maintain a database of pre-vetted suppliers. This can significantly speed up the procurement cycle for tactical and operational needs.

The following video provides further context on the importance of due diligence in your supply chain.

Organisations like Johnson & Johnson use sophisticated supplier qualification systems across all business divisions to ensure consistency and compliance. Similarly, financial institutions such as Bank of America have rigorous third-party onboarding processes designed to meet strict regulatory requirements. Adopting a similar structured approach transforms vendor selection from a reactive decision into a strategic risk management function.

6. Regular Business Reviews and Relationship Management

Moving beyond transactional interactions is crucial for unlocking the full potential of your vendor ecosystem. A systematic approach to relationship management, centred on regular business reviews, transforms suppliers into strategic partners who actively contribute to mutual value creation. This practice formalises communication, aligns strategic goals, and builds a foundation of trust and collaboration.

Implementing a structured cadence of reviews ensures that performance is consistently monitored, issues are resolved proactively, and opportunities for innovation are identified. It involves scheduled meetings, joint business planning, and clear escalation pathways, which are essential components of modern vendor management best practices.

How to Implement Regular Business Reviews

To establish an effective review and relationship management framework, begin by tailoring the frequency and depth of engagement to your vendor segmentation tiers. Critical partners require more intensive, strategic engagement, while transactional suppliers can be managed with lighter, more operationally focused check-ins.

- Structure Your Agendas: Prepare formal agendas that balance operational performance metrics with strategic discussions. Cover past performance, current projects, upcoming initiatives, and long-term goals.

- Involve Diverse Stakeholders: Include representatives from various functions (e.g., procurement, operations, finance, IT) from both your organisation and the vendor’s. This ensures a holistic perspective and strengthens relationships at multiple levels.

- Document and Follow Up: Diligently record meeting minutes, decisions, and action items. Assign clear ownership and deadlines, and consistently track progress to ensure accountability and drive results.

- Assess Relationship Health: Periodically use relationship health surveys or scorecards to gauge sentiment, identify points of friction, and uncover areas for improvement before they escalate into significant problems.

Companies like Toyota have perfected this with supplier development programs that are now industry benchmarks, fostering deep, collaborative partnerships. Similarly, Starbucks’ C.A.F.E. Practices program demonstrates how relationship management can extend to shared goals like sustainability, strengthening the entire supply chain. By adopting a similar, structured approach, you can foster partnerships that deliver innovation, reliability, and sustained competitive advantage.

7. Contract Lifecycle Management and Optimisation

Effective vendor management is impossible without robust control over the contracts that govern these relationships. Contract Lifecycle Management (CLM) is a comprehensive approach that systematically manages vendor agreements from initial drafting and negotiation through execution, performance monitoring, and eventual renewal or termination. This practice ensures all parties adhere to their obligations, maximises value, and minimises legal and financial risks.

By implementing a formal CLM process, an organisation transforms contracts from static legal documents stored in a filing cabinet into dynamic, value-generating assets. This strategic oversight allows for proactive management of key dates, obligations, and performance metrics, ensuring that the agreed-upon value is fully realised and that opportunities for optimisation are never missed.

How to Implement Contract Lifecycle Management

A successful CLM strategy integrates technology, process, and people. It begins with creating a centralised, accessible repository for all contracts and defining clear workflows for each stage of the contract’s life. This approach provides visibility and control, which are critical for managing a diverse vendor portfolio.

- Standardise and Automate: Develop standardised contract templates for different vendor types and services to accelerate negotiations and reduce legal risk. Implement a CLM system, like those offered by Icertis or DocuSign, to automate workflows and set up alerts for critical milestones like renewal dates or performance reviews.

- Track Performance Against Terms: Actively monitor vendor performance against the specific Service Level Agreements (SLAs) and Key Performance Indicators (KPIs) defined in the contract. This requires linking contract terms to performance data, allowing for objective, evidence-based conversations with vendors.

- Conduct Regular Reviews: Don’t let contracts sit idle. Schedule regular reviews to identify opportunities for optimisation, such as renegotiating pricing, adjusting service levels, or consolidating services with a single vendor. This is a core practice for companies like General Motors, which uses its platform to manage complex automotive supplier agreements.

- Plan for the End: Every contract should include clear and fair termination and transition clauses. This ensures a smooth off-boarding process if a relationship ends, protecting your organisation from service disruptions and data loss.

Organisations like Pfizer rely on sophisticated CLM systems to ensure strict compliance with complex pharmaceutical industry regulations across thousands of vendor agreements. Adopting this best practice moves vendor management beyond simple procurement, creating a strategic function that actively protects the organisation and extracts maximum value from every commercial relationship.

Vendor Management Best Practices Comparison

| Item | Implementation Complexity | Resource Requirements | Expected Outcomes | Ideal Use Cases | Key Advantages |

|---|---|---|---|---|---|

| Strategic Vendor Segmentation and Classification | High (requires data analysis and periodic updates) | Moderate to High (data gathering, analytics tools) | Optimised resource allocation; focused vendor management | Managing diverse vendor portfolios; risk-based management | Enhances vendor focus; improves negotiation; risk prioritisation |

| Comprehensive Vendor Risk Assessment and Monitoring | High (continuous monitoring, multiple risk dimensions) | High (risk tools, integration with platforms) | Early risk detection; reduced disruptions; compliance | High-risk vendors; regulated industries | Proactive risk management; regulatory compliance; improved continuity |

| Performance Management Through SLAs and KPIs | Moderate (defining metrics, monitoring systems) | Moderate (performance tracking tools, reviews) | Clear accountability; continuous service improvement | Vendor relationship performance tracking; contract management | Drives improvements; accountability; data-driven decisions |

| Centralised Vendor Information Management System | High (system implementation, integration) | High (IT resources, training, maintenance) | Single source of truth; improved coordination and analytics | Organisations with large vendor base; data consistency needs | Eliminates silos; improves visibility; streamlines processes |

| Structured Vendor Onboarding and Due Diligence Process | Moderate to High (workflow setup, multi-stage processes) | Moderate (cross-functional resources, tools) | Reduced onboarding time; consistent evaluation; risk reduction | New vendor qualification; compliance-heavy environments | Ensures thorough vetting; speeds onboarding; reduces risks |

| Regular Business Reviews and Relationship Management | Moderate (planning and coordination effort) | Moderate (time from key stakeholders) | Stronger partnerships; proactive issue resolution; innovation | Strategic and critical vendor relationships | Builds collaboration; drives value creation; improves alignment |

| Contract Lifecycle Management and Optimisation | Moderate to High (system deployment, process standardisation) | Moderate to High (contract management tech, training) | Reduced risks; optimised contracts; compliance enforcement | Organisations with complex or numerous contracts | Improves negotiation; reduces risk; enhances contract visibility |

Activating Your Strategic Vendor Framework

Transitioning from a collection of disparate tactics to a cohesive, strategic framework is the ultimate objective of mastering vendor management. The seven pillars we have explored, from strategic segmentation to disciplined contract lifecycle management, are not independent functions. Instead, they represent interconnected components of a single, powerful engine designed to drive value, mitigate risk, and foster innovation throughout your supply chain. Implementing these vendor management best practices transforms your supplier relationships from simple transactional exchanges into strategic partnerships that deliver a genuine competitive advantage.

The journey begins by understanding that not all vendors are created equal. Strategic segmentation allows you to allocate your most valuable resources, time, and attention where they can have the most significant impact. This foundational step informs every subsequent action, from the depth of your due diligence and risk assessments to the frequency and nature of your business reviews. A centralised information system acts as the central nervous system for this framework, ensuring data integrity, accessibility, and a single source of truth that empowers decisive, informed action across your organisation.

From Theory to Action: Your Next Steps

Merely understanding these concepts is insufficient; the real value is unlocked through consistent application and a commitment to continuous improvement. To activate your strategic vendor framework, consider the following actionable steps:

- Conduct an Immediate Portfolio Review: Start by applying the segmentation model discussed. Classify your current vendors into strategic, tactical, and transactional tiers. This initial exercise will immediately highlight where your current efforts are misaligned with vendor importance.

- Audit Your Core Processes: Evaluate your existing onboarding, risk assessment, and performance tracking procedures against the best practices outlined. Identify the most significant gaps. Are your SLAs measurable and aligned with business goals? Is your risk monitoring proactive or purely reactive?

- Prioritise Technology Enablement: Manually managing dozens, let alone hundreds, of vendors is an unsustainable model that invites inefficiency and error. Assess how a centralised Vendor Management System (VMS) could automate repetitive tasks, standardise workflows, and provide the analytics needed for strategic oversight.

The Lasting Impact of a Modernised Approach

Embracing these sophisticated vendor management best practices is more than an operational upgrade; it’s a fundamental shift in business philosophy. It moves your organisation from a reactive, cost-centric procurement function to a proactive, value-driven partnership hub. The benefits extend far beyond cost savings, fostering resilience against supply chain disruptions, accelerating innovation through deeper collaboration, and ensuring regulatory compliance in an increasingly complex global landscape.

A well-managed vendor ecosystem becomes a source of strength, agility, and sustainable growth. By investing the effort to build this framework, you are not just optimising processes; you are building a more robust, competitive, and future-ready enterprise. The path requires discipline and strategic foresight, but the return on investment is a resilient and high-performing network of partners dedicated to mutual success.

Ready to replace fragmented spreadsheets and manual processes with a powerful, centralised system? Discover how Osher Digital can automate your workflows and centralise vendor data – visit Osher Digital to see how you can transform your vendor management from a cost centre into a strategic advantage.

Jump to a section

Ready to streamline your operations?

Get in touch for a free consultation to see how we can streamline your operations and increase your productivity.